By David Enna, Tipswatch.com

Last January, Series I Savings Bonds offered a fixed rate of 1.20% and had a lot of appeal. A year later, that fixed rate has fallen to 0.90%. Are I Bonds still relevant for investors seeking safety and protection against unexpected inflation?

Yes, I’d say they remain relevant and still attractive at a time when short-term interest rates are declining. The current composite rate is 4.03%, up from 3.11% last January. That is better than the 13-week Treasury yield of about 3.70%.

This year, however, the I Bond purchase equation is a little complicated. Instead of loading up in January, I am recommending holding off until later in the year. But first …

The basics

- The fixed rate of an I Bond will never change. Purchases through April 30, 2026, will have a fixed rate of 0.90%, which means the return will exceed official U.S. inflation by 0.9% until the I Bond is redeemed or matures in 30 years.

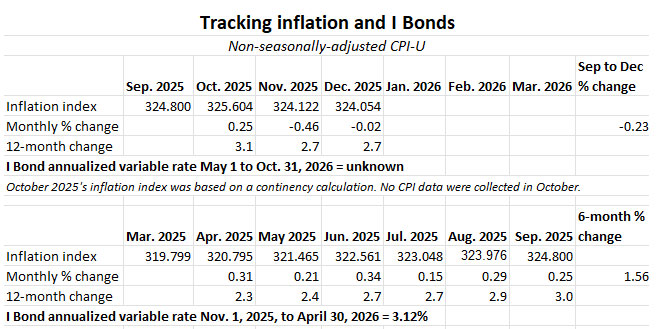

- The inflation-adjusted rate (often called the I Bond’s variable rate) changes each six months to reflect the running rate of inflation. That rate is currently 3.12%, annualized, for six months. It will adjust again on May 1, 2026, rolling into effect for all I Bonds, no matter when they were purchased.

- The current composite rate is 4.03% annualized for six months for purchases through April 2026.

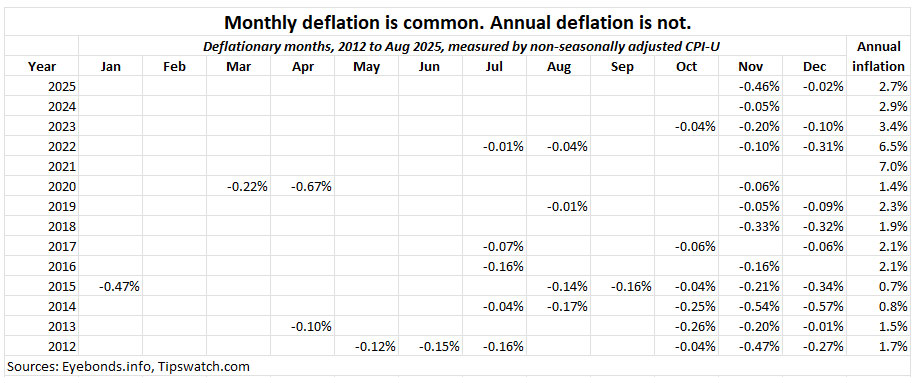

I Bonds are an extremely safe and conservative investment. Interest accrues monthly and principal can never decline, even in times of deflation. Investments are limited to $10,000 per person per calendar year for electronic I Bonds held at TreasuryDirect. There is also a “gift box” strategy some investors use to stack purchases for future years.

I Bonds are a unique investment with many positives. For example, earnings are free of state income taxes and federal taxes can be deferred until the I Bond is redeemed or matures. Also, I Bonds are a simple investment to buy and track, much simpler than a TIPS with a constantly changing market value and inflation accruals that update daily.

Looking ahead

An investor who purchases an I Bond through April 2026 will earn the composite rate of 4.03% for a full six months, no matter the month of purchase. After that, the fixed rate will remain at 0.90% but the composite rate will change. So what’s ahead?

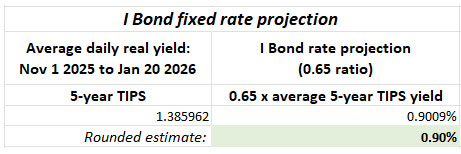

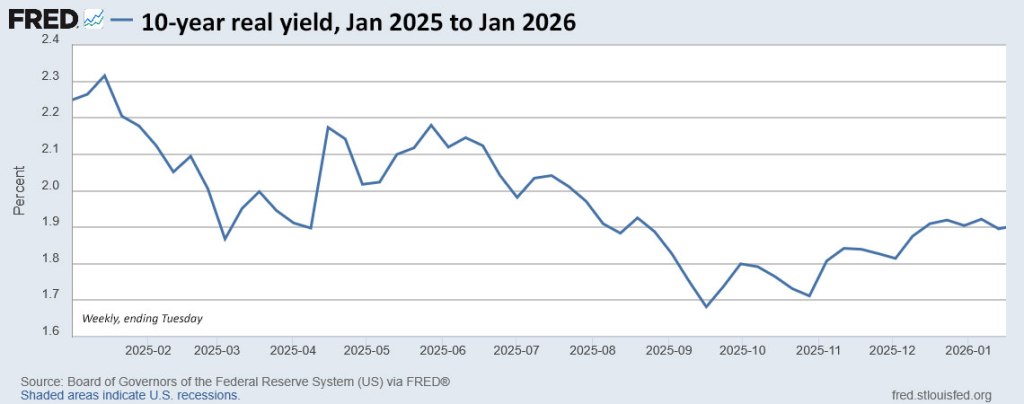

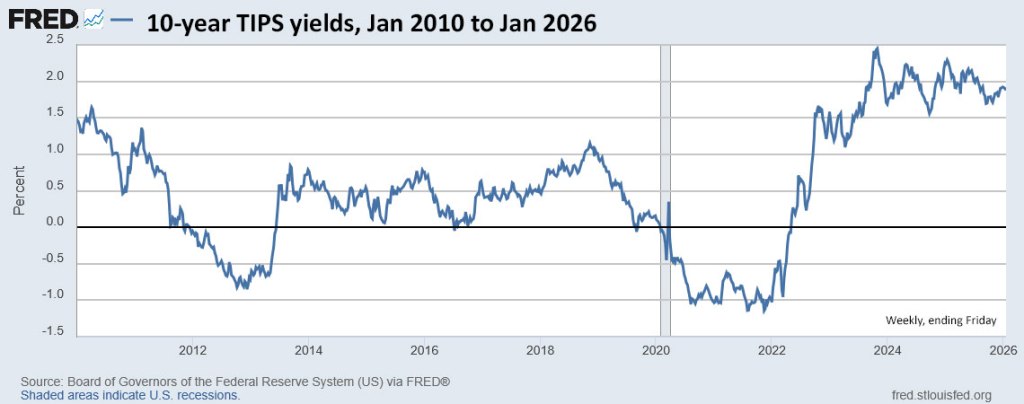

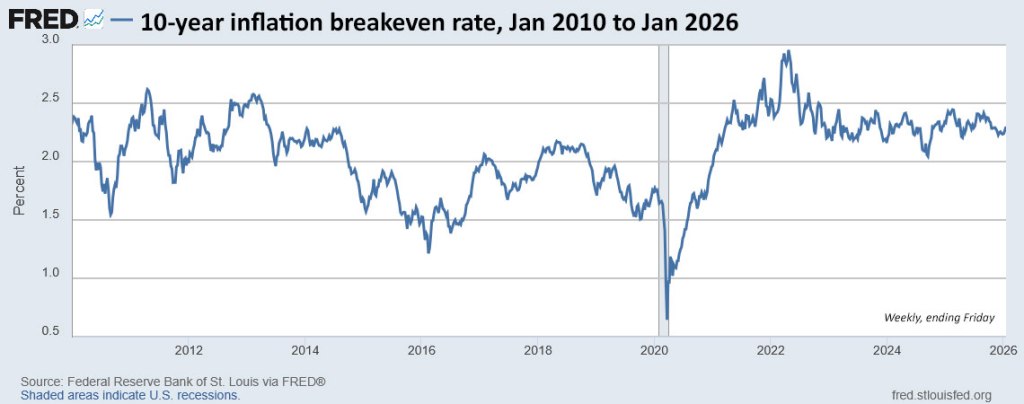

Future fixed rate. Although the U.S. Treasury does not reveal its formula for determining the I Bond’s fixed rate, we know Treasury tracks trends in real yields and adjusts accordingly. This forecasting formula has worked for the last decade: Take the average real yield of the 5-year TIPS over the preceding six months and apply a ratio of 0.65.

The next rate reset will come May 1, so we are interested in real yields from November 2025 to April 2026. So far, we are less than three months into that period, but here are the current results:

At this point, the projection points to the I Bond fixed rate remaining at 0.90% at the May reset. But a lot can change in the next three months, especially if the Federal Reserve moves to cut short-term interest rates in the meantime.

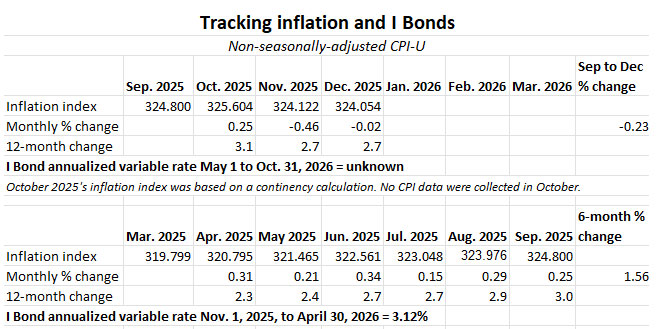

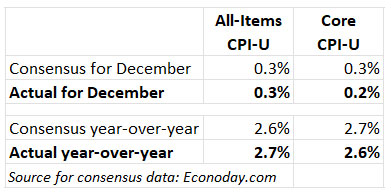

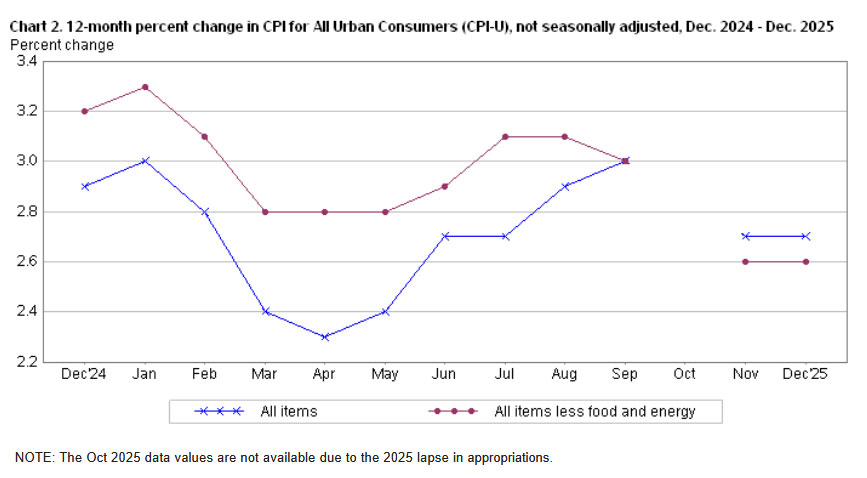

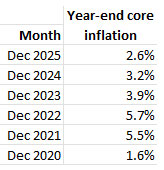

Variable rate. We are just getting out of a period of chaotic statistical information from the U.S. government, caused by last year’s government shutdown. No inflation data were collected in October and November’s numbers were suspect, especially in the way housing data were reported. The result was a very sharp drop in November’s non-seasonally adjusted inflation, down 0.46% for the month.

The I Bond’s next variable rate will be set based on non-seasonally adjusted inflation for the months of October 2025 through March 2026. Three months into that period, we’ve had deflation of 0.23%, which would translate to a variable rate of -0.46% at this point.

This negative number is going to turn around in the months of January to March and will very likely end up positive. Non-seasonally adjusted inflation runs higher than headline inflation at the beginning of the year. But how much of an increase can we expect? The last three years give us an idea:

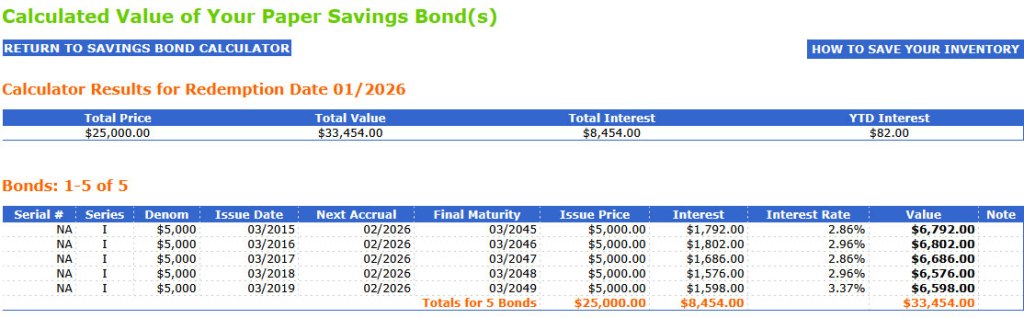

- In December 2024, 3-month inflation was only 0.11%. By March that increased to 1.43%, setting the variable rate 2.86%.

- In December 2023, 3-month inflation was -0.34%. By March it increased to 1.48%, setting the variable rate at 2.96%.

- In December 2022, 3-month inflation was 0.0%. By March it increased to 1.69%, setting the variable rate at 3.38%.

Conservatively, I’d say expect six-month inflation of at least 1.00%, which would result in a variable rate of 2.00%.

Composite rate. If the fixed rate holds at 0.90% and the variable rate drops to 2.00%, you’d get a new composite rate of 2.91%, well below the current rate of 4.03%. Again, I emphasize that this is a conservative estimate.

In this conservative scenario, an I Bond purchase any time through April 2026 will earn 4.03% for six months and then 2.91% for six months, for a combined annual return of about 3.47%.

When to act

There is no reason to jump aboard an I Bond investment in January 2026. You can get that 0.90% fixed rate and the six-month composite of 4.03% anytime through April 2026. So just be patient.

First buying window. This will come after the March inflation report is issued on April 10, 2026. That report will lock in the I Bond’s new variable rate, and we will have a much better idea of the potential fixed-rate reset coming May 1. You will have more than two weeks to decide: Buy in April, buy in May or continue waiting?

If the fixed rate looks likely to fall, I would be a buyer in April, no matter what the six-month variable rate will be. The fixed rate is permanent and is much more important for anyone planning to hold for five years or longer.

Second buying window. The second decision period will come after the September inflation report is issued October 14, 2026. Again, at that point you will know with certainty the next variable rate — to be reset November 1 — and have a good idea of the next fixed rate.

Most likely, I will be buying in April. Still, waiting is the best action right now.

Short-term investment?

The current composite rate of 4.03% certainly looks attractive when you compare it to the nominal yields of a 4-week (3.75%) or 1-year (3.53%) T-bill. But remember than you have to hold an I Bond for one year and if you redeem at that point you lose the latest three months of interest.

The answer is no. My conservative scenario had a one-year I Bond return of 3.47%, but that would drop to about 2.74% if you subtract the last three months of interest. If you are looking for a one-year investment, just buy the 1-year T-bill at 3.53%.

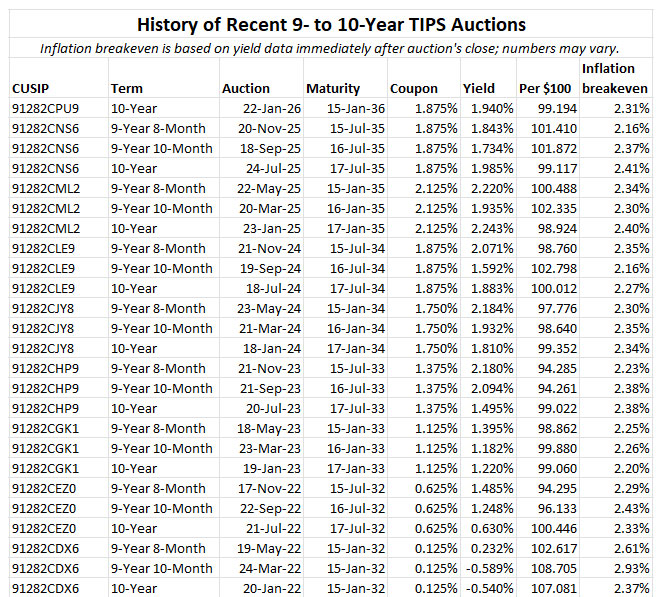

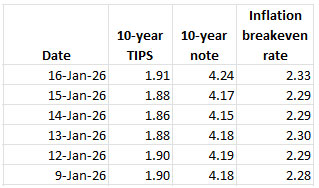

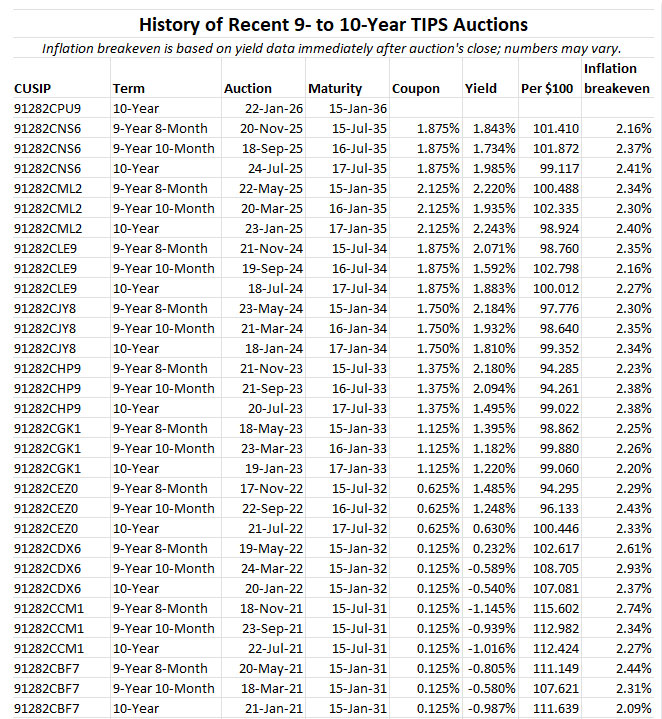

I Bond versus TIPS

A five-year TIPS currently has a real yield of about 1.38%, a lofty 48 basis points higher than the I Bond. These are comparable investments, since the I Bond can be redeemed without penalty after five years. For pure yield, the TIPS is the better investment. The I Bond has advantages of tax-deferred interest, flexible maturity and rock-solid deflation protection.

I invest in both, but use TIPS for pushing forward specific inflation-protected spending levels into the future. I use I Bonds as a secondary emergency cash reserve, constantly protected against inflation.

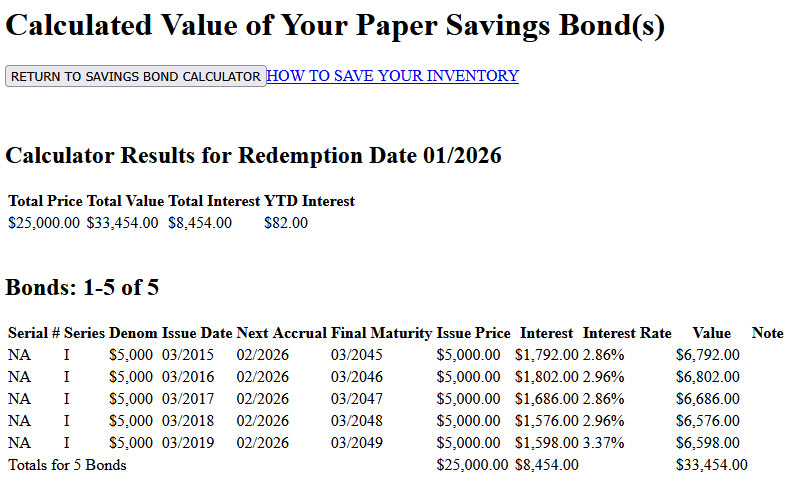

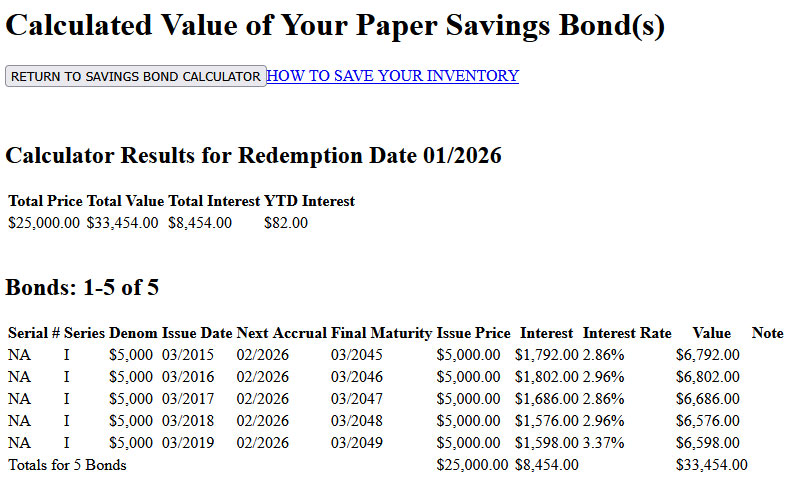

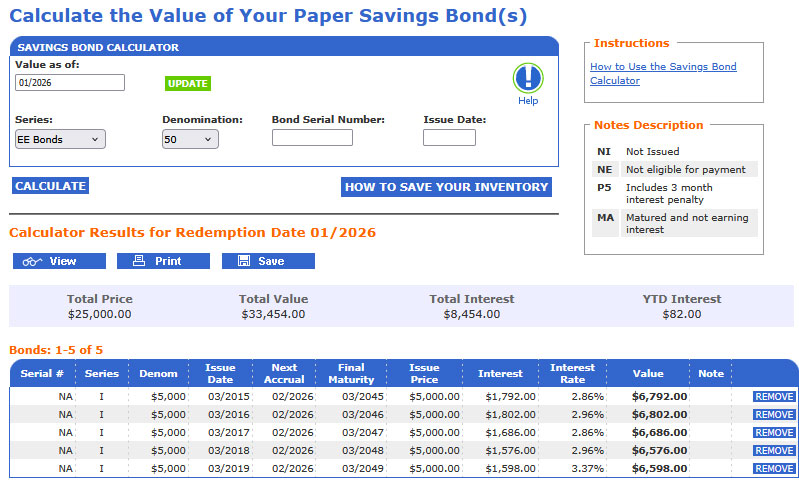

The rollover strategy

If you are holding I Bonds with 0.0% fixed rates, you are currently earning a composite rate of 3.12%, but that could fall to as low as 2.0% (or lower) later this year. You could redeem some of those to raise cash to buy I Bonds with a 0.9% fixed rate.

I generally encourage people to continue holding I Bonds “until you need the cash.” It’s great to have these savings bonds growing tax-deferred with zero risk. But this strategy of rolling over 0.0% I Bonds for a 0.9% fixed rate makes sense.

You will owe federal income taxes on the interest earned, and if your withdrawal is more than $10,000 (because of earned interest) you’ll only be able to buy $10,000 in new I Bonds in 2026. And if you held the I Bond less than 5 years, you will get hit with the three-month interest penalty.

The rollover strategy especially makes sense for people who are retired and have no way to raise cash for an I Bond purchase without selling an asset or withdrawing IRA money, both creating tax hits.

Reminder: When you redeem an I Bond, you earn zero interest for the month of that transaction. So the best idea is to redeem early in the month, like January 2 or April 2. Then, purchase I Bonds late in the month, because they will earn that full month of interest. For short-term investors, this can cut the holding period to very close to 11 months.

Thoughts

Despite the decent fixed rate of 0.90%, I suspect there won’t be rabid interest in I Bonds this year. But that could change if short- and longer-term Treasury rates begin falling. That 0.90% will be there through April, just waiting for your decision.

Most likely, I will be investing in I Bonds in 2026, possibly in April and probably rolling over some lower-fixed-rate I Bonds to raise the cash.

What do you think? Will you be investing in I Bonds in 2026? Or have you set plans for other (preferably safe) investments? Post your thoughts in the comments section.

• Confused by I Bonds? Read my Q&A on I Bonds

• Let’s ‘try’ to clarify how an I Bond’s interest is calculated

• Inflation and I Bonds: Track the variable rate changes

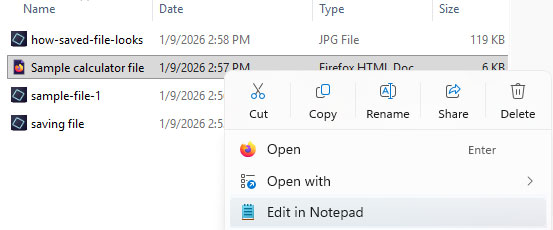

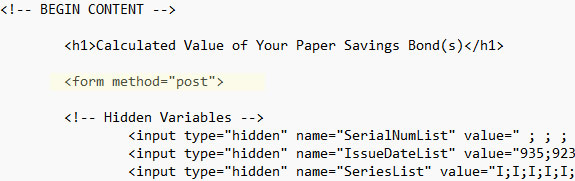

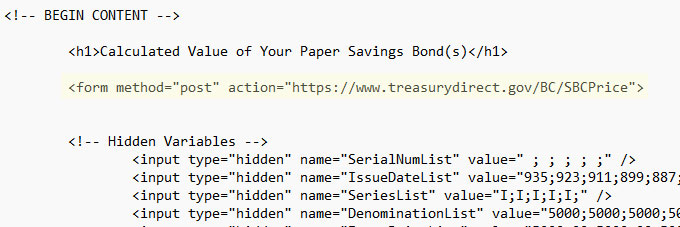

• I Bonds: Here’s a simple way to track current value

• I Bond Manifesto: How this investment can work as an emergency fund

—————————

Donate? This site is free and I plan to keep it that way. Some readers have suggested having a way to contribute. I would welcome donations. Any amount, or skip it, your choice. This is completely optional.

—————————

Follow Tipswatch on X for updates on daily Treasury auctions and real yield trends (when I am not traveling).

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear. Please stay on topic and avoid political tirades. NOTE: Comment threads can only be three responses deep. If you see that you cannot respond, create a new comment and reference the topic.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

I can’t disagree with your premise. My traditional IRA includes backup holdings in Vanguard Wellington and Total Bond Fund. Those…