By David Enna, Tipswatch.com

The February inflation report, just released by the Bureau of Labor Statistics, already feels like ancient news. The U.S. inflation picture has changed dramatically 11 days into March, with gas prices and other energy costs soaring higher.

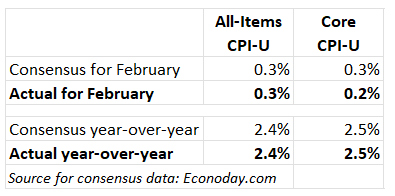

In February, seasonally adjusted all-items inflation rose 0.3% for the month and held steady at 2.4% for the year, the BLS reported. Core inflation rose 0.2% for the month (below expectations) but held steady at 2.5% for the year, its lowest rate since March 2021. All in all, this is what markets were expecting.

But … it’s old news. Inflation in March looks likely to run hotter because of rising energy costs (and related pass-on costs) and then in April we should get an adjustment to shelter data missing because of the October government shutdown. The new shelter data could also result in a boost to the annual rate. Plus, add in the year-over-year effect of mild deflation (-0.1%) in March 2025.

This is from Claude.ai on the effect of a 15% increase in gas prices:

Gasoline (all types) carries roughly a 3.5% weight in the all-items CPI-U basket. So a 15% increase in gas prices, in isolation, would contribute approximately: 3.5% × 15% ≈ +0.53 percentage points to the monthly all-items CPI reading.

As of this morning, the Cleveland Fed’s Inflation Nowcasting site is forecasting a monthly rate of 0.46% for March, and an annual rate of 2.87%, which would round to 2.9%. (FYI, these numbers are often wrong.)

In the February report, the BLS noted that shelter costs increased 0.2% for the month and are now up 3.0% for the year. But this is the one CPI statistic that looks most questionable because of October’s missing data. The BLS assumed shelter costs remained flat that month, which was highly unlikely. Also in the report:

- Gasoline costs rose 0.8% in February, but were down 5.6% year over year. In March, so far, the increase has been at least 15%, but prices could continue to rise.

- Fuel oil costs increased 11.1% for the month and are up 6.2% for the year.

- Costs for piped gas service increased 3.1% for the month and are up 10.9% for the year.

- Food at home costs rose 0.4% for the month and were up 2.4% for the year.

- Costs of new vehicles held steady and are up only 0.5% year over year.

- Costs of used cars and trucks fell 0.4% in the month.

- Airline fares rose 1.4% for the month and 7.1% year over year.

- Costs of medical care services rose 0.6% for the month and were up 4.1% for the year.

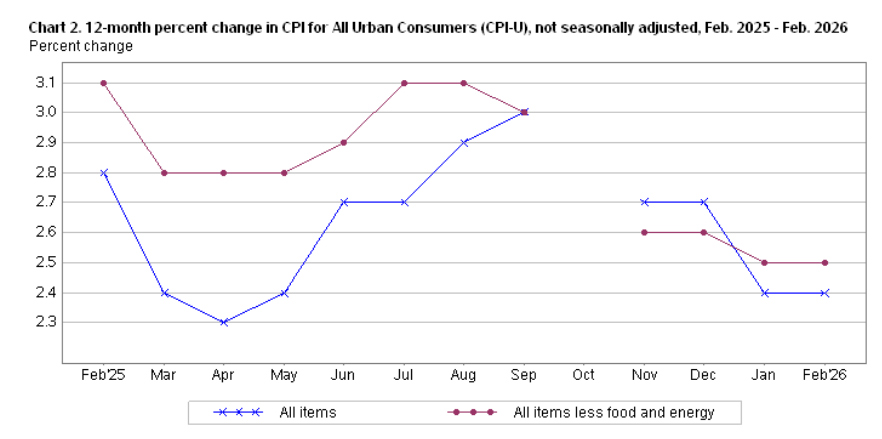

Overall, prices for a lot of categories were mildly higher, and only a few saw price declines. The mild shelter increase helped keep a lid on overall inflation. Here is the trend in U.S. inflation over the last year:

Note the missing October data and the dramatic move downward in annual inflation just after the missing month. Can I say this looks “suspicious”? Time will tell, especially after April when missing shelter data will be restored.

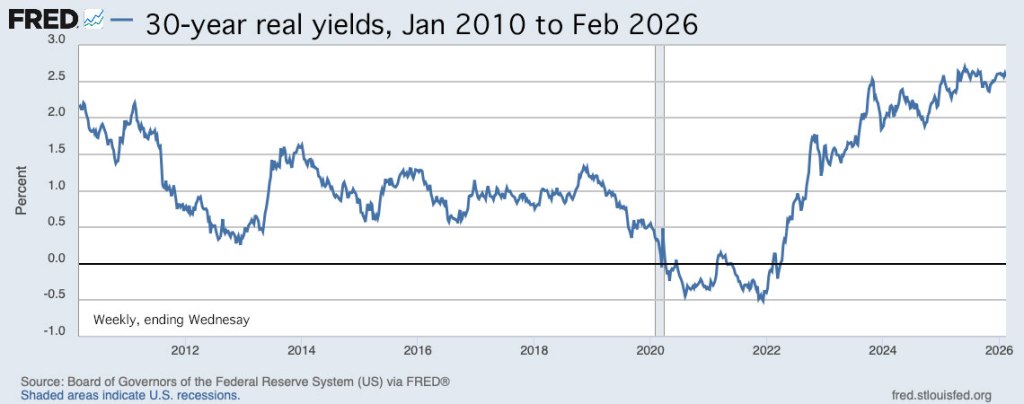

What this means for TIPS and I Bonds

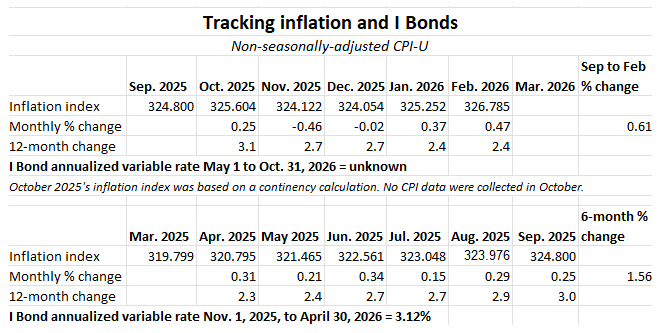

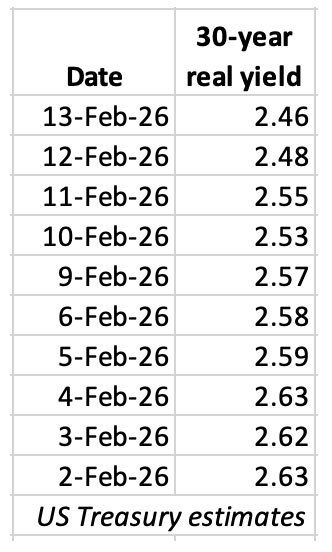

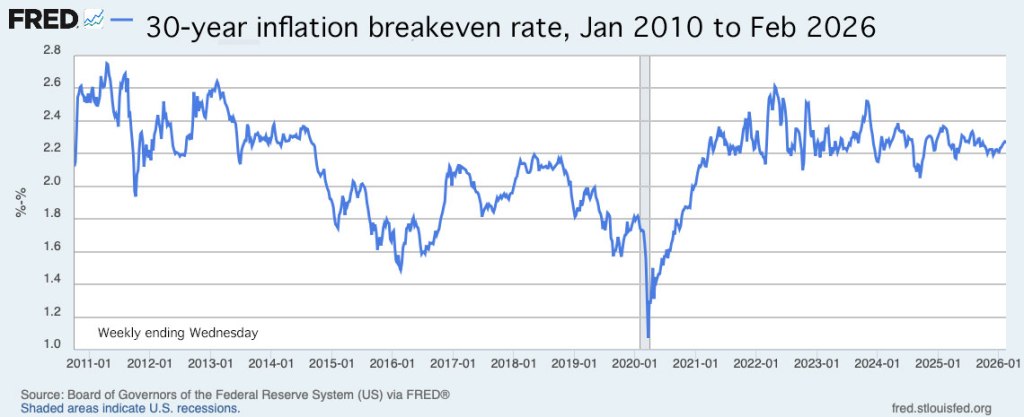

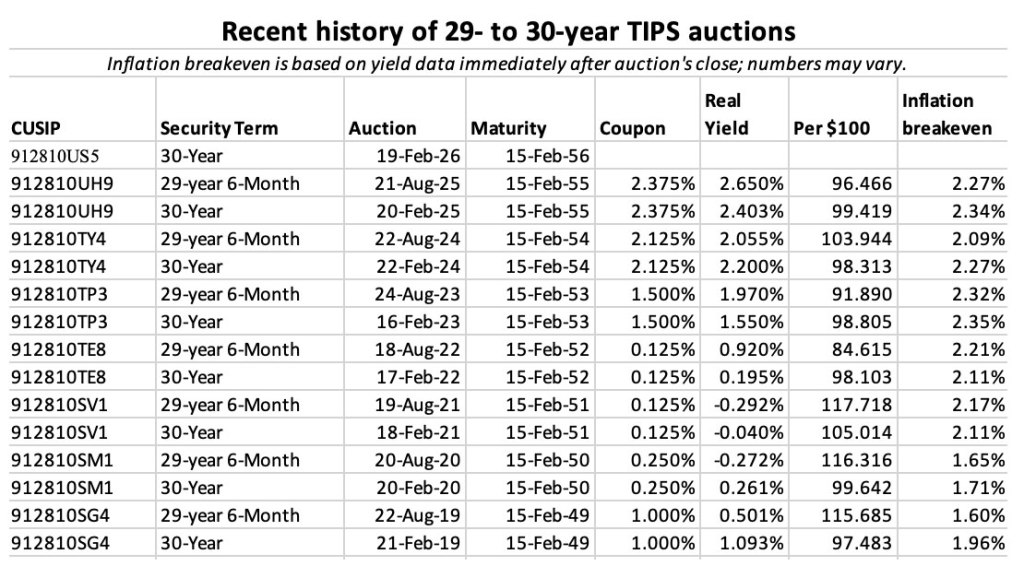

Investors in Treasury Inflation-Protected Securities and Series I Savings Bond are also interested in non-seasonally adjusted inflation, which is used to adjust principal balances for TIPS and set future interest rates for I Bonds. The BLS set the February CPI index at 326.785, an increase of 0.47% over the January number.

For TIPS. The February inflation report means that principal balances for all TIPS will rise 0.47% in April, after rising 0.37% in March. While these seem like lofty numbers, this is a normal pattern in non-seasonally adjusted inflation at the beginning of the year. Here are the new April Inflation Indexes for all TIPS.

• Confused by TIPS? Read my Q&A on TIPS

For I Bonds. February marks the fifth of a six-month string that will determine the I Bond’s new inflation-adjusted variable rate, to be reset May 1 based on inflation for the months of October 2025 through March 2026. So far, with one month remaining, inflation has run at 0.61%, which translates to a variable rate of 1.22%, down from the current 3.12%.

• Confused by I Bonds? Read my Q&A on I Bonds

If non-seasonal inflation runs at 0.4% in March (it could be much higher), we would end up with a variable rate of 2.02%. We could also see a slight decline in the I Bond’s fixed rate at the May 1 reset. I will be writing more about this in April. Here are the relevant data:

What this means for future interest rates

Forget February. The numbers were encouraging, but now with a “military operation” exploding in the Mideast, involving more than a dozen nations, all predictions are pointless. The Federal Reserve will need some sort of certainty before it decides to lower interest rates. For now, the Fed is on hold.

The current headline on Bloomberg is: US CPI Data Relegated to ‘Background Noise’ Amid Iran War. Good one, and accurate. Also from Bloomberg:

Federal Reserve officials are expected to leave interest rates unchanged at their policy meeting next week, a prediction that preceded the latest events in the Middle East. With the war threatening to push up inflation — at least in the near term — some investors now see a chance the central bank will remain on hold for longer.

From the Wall Street Journal:

Before the launch of the U.S.-Israeli war with Iran on Feb. 28, Wednesday’s inflation report would have been a key reading, shaping expectations for Federal Reserve policy in the months ahead. It has been transformed by the conflict into something more like a baseline—the reading against which economists will measure whatever the war does to prices in the months ahead.

“The February data is already completely inconsequential,” said Joseph Brusuelas, chief economist at RSM, shortly before the report was released.

I get criticized for using the word “uncertain” too often, but once again we have entered highly uncertain times. Now we must wait and watch.

—————————

Donate? This site is free and I plan to keep it that way. Some readers have suggested having a way to contribute. I would welcome donations. Any amount, or skip it, your choice. This is completely optional.

—————————

Follow Tipswatch on X for updates on daily Treasury auctions and real yield trends (when I am not traveling).

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear. Please stay on topic and avoid political tirades. NOTE: Comment threads can only be three responses deep. If you see that you cannot respond, create a new comment and reference the topic.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

"minimal additional deaths and injuries to our brave troops" - it's not like they are at risk of being shot…