By David Enna, Tipswatch.com

One of the great “joys” of having an account at TreasuryDirect is hunting for information on federal taxes you might owe on last year’s transactions. It’s not easy, and even when you find the information, it is surprisingly cryptic.

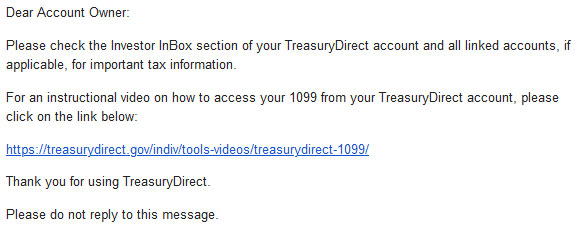

You need to find 1099 forms for each account you have at TreasuryDirect. You will get nothing in the mail, but you will get an email that is easy to miss. I got an alert from reader Doug on January 21 that the 1099s had been posted (seems earlier than normal), and three days later got the very important email:

TreasuryDirect’s 2-minute video (which was produced several years ago) is actually helpful, and it plays on YouTube, so you can watch it right here:

As the video notes, if you are part of a couple with separate accounts, or if you have linked accounts from converting paper I Bonds, or child accounts, or separate trust or entity accounts, you will need to go to the linked accounts and get separate 1099s. In the case of a spouse, you will need to log out and re-login to that separate account to find the second 1099. Here is what TreasuryDirect says:

It is important to check ALL of your accounts, as a separate Form 1099 will be created for each one. If you have established Custom, Minor-Linked, or Conversion-Linked accounts, you must access each account to print the Form 1099 for that account.

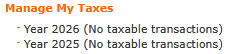

However, if you use your TreasuryDirect account simply to buy savings bonds (I Bonds or EE Bonds) and didn’t redeem any or have any mature in 2025, there will be no taxable transactions and you won’t have 1099s. You will see this on TreasuryDirect’s ManageDirect page:

TreasuryDirect is NOT going to mail you these forms. You need to hunt them down.

Important: Once you are inside the account section of TreasuryDirect, never click on your browser’s back button. If you do, you will be booted out of TreasuryDirect and you will have to log in again. To navigate, either click on the top row of tabs or click “return” at the bottom of most pages.

Here is the basic step-by-step process for finding each set of 1099s:

- Log into your TreasuryDirect account on this page. Click “Next.”

- Enter your account number and click “Submit.”

- After you enter the account number, you will get a message that a verification code has been sent to the associated email address. Open the email, copy the code and paste it in the box. Click “Submit.”

- Enter your password and click “Submit.”

- Now you are on your MyAccount page on TreasuryDirect. From here you can click on your Investor InBox in the upper navigation to see further instructions. The message will be titled “Tax Statement Notification.”

Important tax information for the recently concluded tax year is now available. The Form 1099 may be accessed through the ManageDirect tab in your TreasuryDirect account. A Form 1099 will NOT be mailed to you.

- Next, click on the “ManageDirect” link in the upper navigation. Under the heading, Manage My Taxes, select the link for the 2025 tax year. Then click the link: “View your 1099 for tax year 2025.” (Make sure to select 2025, not 2026.)

- At this point, you may get a huge listing of all of your interest payments, savings bond redemptions, potential capital gains and original issue discount accruals for Treasury Inflation-Protected Securities.

- TreasuryDirect does not offer an easily printable .pdf version of this form. To print it, click anywhere on the browser page and hit CONTROL P on a PC or COMMAND P on a Mac. This should open up a dialog to print the pages. (Mine was 10 pages long.)

- Print the 1099. (Your computer may also give you the option to “print to .pdf” which will allow you to save the document before printing.)

- Don’t have a printer? You can copy the entire text of the 1099 and paste it into a text or Word document. Save that file for reference when you fill out your tax return.

- At the bottom of the page, click on “Return.” Repeat the process for any additional spousal or linked accounts.

Just to make things more aggravating: Once you open your 1099 page, there will be no top tabs and you will need to scroll all the way to the bottom (10 pages!) to get to the “Return” button. Do not click on the back arrow or you will get logged out of TreasuryDirect.

Examine the 1099

There is a lot to see here, and you don’t want to miss anything that needs reporting to the IRS. On a 1099 from any brokerage or bank, everything is nicely organized and summed up, with clear references to the proper boxes on your tax filing. Not so with TreasuryDirect. In fact, this 1099 is actually a collection of 1099 forms, each with special purposes.

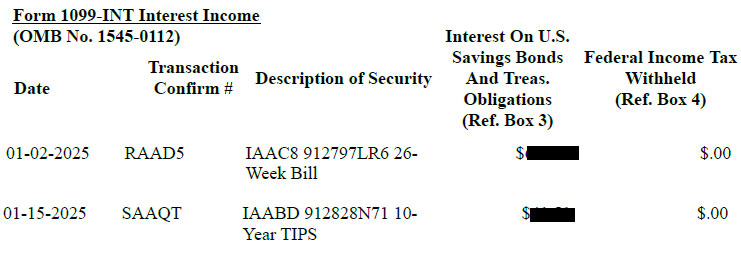

Form 1099-INT Interest Income

If you invested in any T-bills, Treasury notes or bonds, TIPS or redeemed savings bonds in 2025, you are going to see all interest-paying transactions listed here. In 2025 I was rolling over staggered T-bills at TreasuryDirect, plus had a collection of TIPS, plus redeemed a couple 0.0% I Bonds, so my list was enormous. Example:

At the bottom of this long list, a long way down, is the total. Scroll all the way back up to the top to see that this total is Interest On U.S. Savings Bonds And Treas. Obligations and it goes in Ref. Box 3 on the federal tax form when you are filling out the section for 1099-INT. Here is the definition of Box 3:

Shows interest on U.S. Savings Bonds, Treasury Bills, Treasury Notes, Treasury Bonds and Treasury Inflation-Protected Securities (TIPS). … This interest is exempt from state and local income taxes.

You want to make sure the interest gets recognized as coming from U.S. Treasurys, because it will be free of state income taxes.

If you had any proceeds withheld for tax purposes (highly unlikely) those totals will be listed in column 5 of this section.

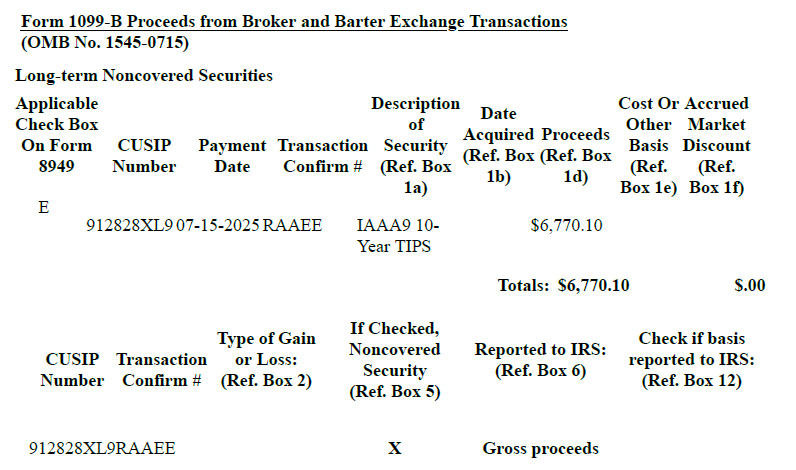

Form 1099-B Proceeds from Broker and Barter Exchange Transactions

There are several sections to form 1099-B and I generally have one or two transactions listed here. This is a very confusing section of the form and offers many opportunities for taxpayers to scream and pull out their hair. I believe the purpose is to show the Accrued Market Discount on longer-term investments that matured in 2025. This is my sole transaction listed for 2025:

Reminder: THIS IS CONFUSING. I am leaving the dollar amount in this one because it is important in determining how to translate this to your tax return. For some reason, even though I bought this TIPS at TreasuryDirect in 2015, TreasuryDirect doesn’t seem to know how much I paid for it. So it is simply reporting gross proceeds.

Some taxpayers might assume they need to report that $6,770.10 as taxable income, which would be entirely wrong and costly. My original investment in this TIPS was $5,000 par value. The extra $1,770.10 I received at maturity was from inflation accruals, which have already been taxed every year for the last 10 years.

So the only taxable event here is: Did I buy this TIPS at a discount or premium to par value? My original cost was $4,957.48 (thankfully I have that recorded). Add $1.770.10 to that amount and you get a cost basis pf $6,727.58.

End result: I owe capital gain taxes on $42.52. (Plus an extra 15 minutes in TurboTax trying to figure out how to enter it correctly.)

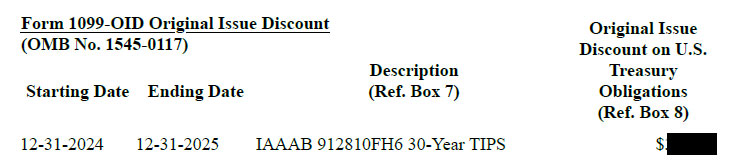

Form 1099-OID Original Issue Discount

This is a very important section for investors who hold TIPS at TreasuryDirect. The 1099-OID lists annual inflation accruals for every TIPS held in the TreasuryDirect account in 2025. These inflation accruals are federally taxable in the year they were earned, even though they were not paid out but just added to principal.

Long-time investors in TIPS are familiar with the 1099-OID, but new investors at TreasuryDirect need to pay heed to this section and report it on their federal tax return.

At the bottom of the list will be the total for all your TIPS holdings. TreasuryDirect notes:

Report this amount as interest income on your federal income tax return. … This OID is exempt from state and local income taxes.

Thoughts

I am no tax expert, so nothing you just read should be considered tax advice. Still, getting these 1099s from TreasuryDirect is EXTREMELY IMPORTANT. And make sure you do this for every account where you had taxable activity (such as maturing T-bills or redemptions of I Bonds).

You are going to get one email with a fairly cryptic message. That’s it. Nothing in the mail. Nothing you can download to Quicken. No .pdf. No easy-to-read tax summary like you receive from your broker. It’s up to you to go to TreasuryDirect, find the 1099s, print them, decipher them and report them on your tax return for 2025.

—————————

Donate? This site is free and I plan to keep it that way. Some readers have suggested having a way to contribute. I would welcome donations. Any amount, or skip it, your choice. This is completely optional.

—————————

Follow Tipswatch on X for updates on daily Treasury auctions and real yield trends (when I am not traveling).

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear. Please stay on topic and avoid political tirades. NOTE: Comment threads can only be three responses deep. If you see that you cannot respond, create a new comment and reference the topic.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

[…] If you want more I bonds, “it’s probably a better bet to buy before the end of April and…