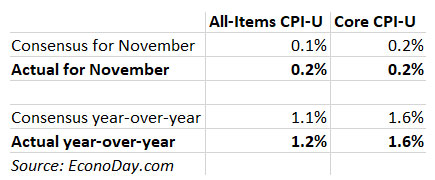

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2% in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 1.2%.

Both the 0.2% increase in monthly inflation and the 1.2% increase in year-over-year inflation were higher than the consensus estimates. Core inflation, however, which strips out food and energy, matched the consensus estimate of 0.2% for the month and 1.6% year over year.

The BLS said the month’s inflation was broad based, with no one sector dominating the results. Food prices dropped 0.1% for the month, but remain up 3.7% over the last year. Gasoline prices, often a key factor in monthly inflation, dropped 0.4% for the month. Gas prices are down 19.3% over the last year.

Apparel prices were up a sharp 0.9%, and costs of transportation services were up an even higher 1.8%. The index for airline fares rose 3.5% in November after increasing 6.3% in October. Airlines took advantage of a bump in holiday travel, but this trend could begin reversing as pandemic lockdowns begin taking effect across the nation.

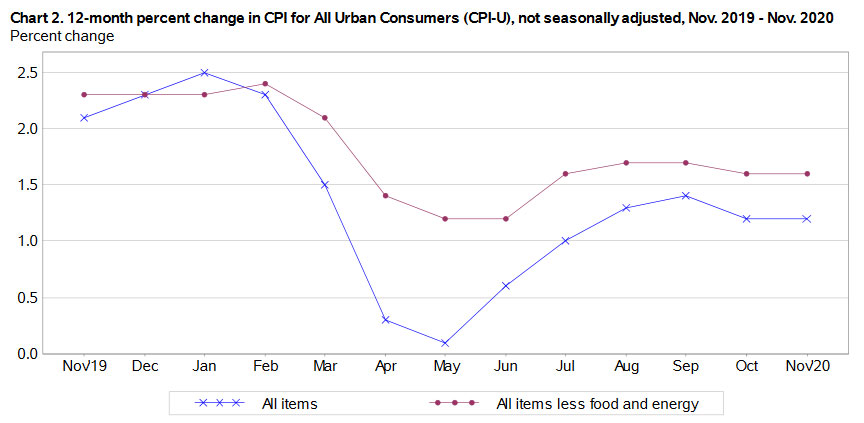

Here’s a look at the one-year trend in rates for all-items and core inflation, showing the gradual rise higher and then stabilization after the economic turmoil of February and March:

What this means for TIPS and I Bonds

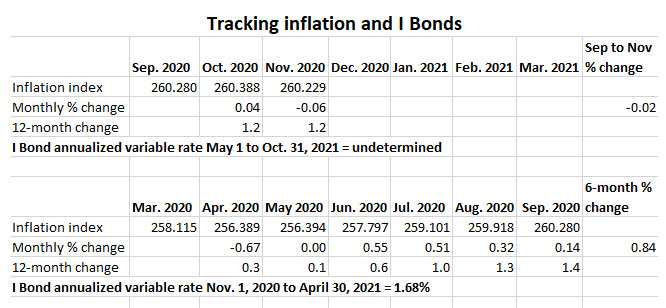

Investors in Treasury Inflation-Protected Securities and U.S. Series I Savings Bond are also interested in non-seasonally adjusted inflation, which is used to adjust principal balances on TIPS and set future interest rates for I Bonds. The BLS set the November inflation index at 260.229, a decline of 0.06% from the October number.

For TIPS. The new November inflation index means that principal balances for all TIPS will be adjusted 0.06% lower in January 2021 after rising 0.04% in December. In essence, TIPS are losing a very small amount of principal over the two months. Here are the new January Inflation Indexes for all TIPS.

For I Bonds. The November inflation number is the second of a six-month string that will determine the I Bond’s new inflation-adjusted variable rate, which will be reset on May 1, 2021. After two months, inflation has been running at -0.02%, which would translate to a variable rate of -0.04%. A lot can happen in the next six months, so this shouldn’t concern I Bond investors. Not yet, at least.

We saw a similar pattern in 2019, when non-seasonally adjusted inflation fell 0.05% in November and 0.09% in December, but then rebounded higher in the next three months. That pattern was even more dramatic in 2018, when inflation fell 0.33% in November and 0.32% in December, then rebounded higher.

Here are the inflation data so far for this rate-setting period:

You can see this data going back to 2012 on my Tracking Inflation and I Bonds page.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he recommends can purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Thanks David. Always good facts and figures to digest. Wishing you and your family an enjoyable holiday season. Simon in TN.

Thank you David for all your hard work and perceptive insights. Much appreciated.

Best wishes to you and yours for the holidays.

Appreciate your work and welcome the move from SA.

Thanks so much for keeping us informed. Your work is appreciated.

Another excellent article. THank you

Thanks for the pertinent information as always.

Thanks for your hard work and for keeping us informed!