For the markets and the Fed, June’s inflation report was positive news.

By David Enna, Tipswatch.com

As soon as I arrived in Geneva, Switzerland, this afternoon, I began looking for news on the June inflation report. My arrival was timed — not by choice — close to the release by the Bureau of Labor Statistics at 8:30 a.m ET.

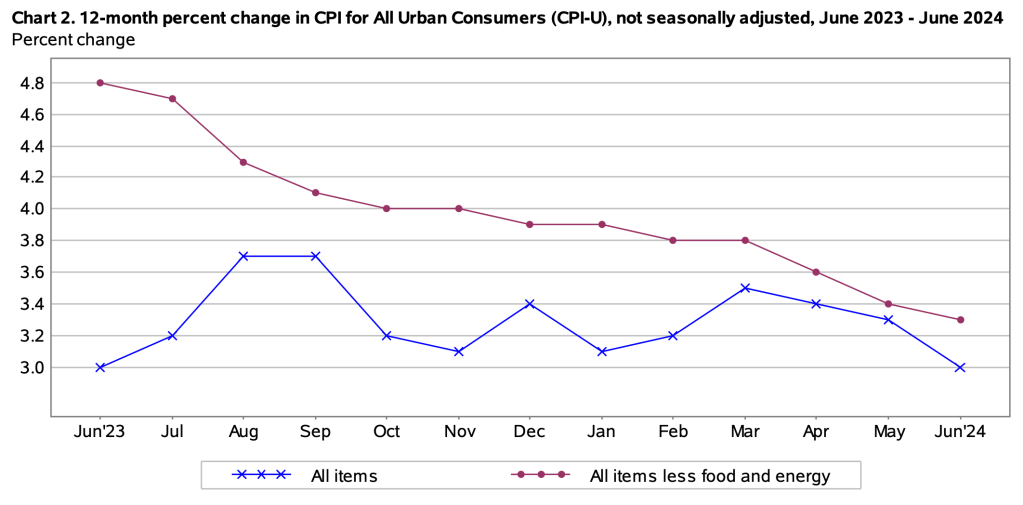

The news was surprising: The Consumer Price Index for All Urban Consumers declined 0.1% on a seasonally adjusted basis, after being unchanged in May, the BLS reported. Annual inflation fell from 3.3% in May to 3.0% in June. Core inflation, which removes food and energy, rose 0.1% for the month and 3.3% for the year, down from 3.5% in May. This was the smallest 12-month increase in core inflation since April 2021.

All of these numbers were below consensus estimates, indicating that inflation could be slowing a bit more than economists — and even the Federal Reserve — had been anticipating. June’s deflation was slight, only negative 0.1%, but the annual rate dipped for both all-items and core inflation.

Gasoline prices, which fell 3.8% in June, again were an important factor in the decline in all-items inflation. Gas prices are now down 2.2% for the year. Shelter costs rose a reasonable 0.2% in June, but are up 5.2% over the last year. Food at home costs rose 0.2% for the month and are up 2.2% over the last year.

Here is the trend in all-items and core inflation over the last 12 months showing the recent disinflationary pattern:

In my opinion, this is exactly the trend, at least since March, that the Federal Reserve has been hoping to achieve.

What this means for TIPS and I Bonds

Investors in Treasury Inflation-Protected Securities and U.S. Series I Savings Bonds are also interested in non-seasonally adjusted inflation, which is used to adjust principal balances on TIPS and set future interest rates for I Bonds. For June, the BLS set the inflation index at 314.175, an increase of just 0.03% over the May number.

For TIPS. The June inflation report means that principal balances for all TIPS will rise 0.03% in August, after rising 0.17% in July. Here are the new July Inflation Indexes for all TIPS.

For I Bonds. The June report is the third in a six-month string that will determine the I Bond’s new inflation-adjusted variable rate, which will be reset on November 1 and eventually roll out to all I Bonds, depending on the original month of purchase.

As of June, inflation has increased only 0.59% over the three months, which would translate to an I Bond variable rate of 1.18%, a disappointing number. But three months remain. A more likely scenario would bring the variable rate up to around 1.80%, still well below the current rate of 2.96%. I Bonds could be a tough sell in November, especially if the permanent fixed rate slips lower than the current 1.3%.

Here are the data so far:

What this means for future interest rates

The Federal Reserve faces an interesting dilemma. I watched Chairman Jerome Powell testify before Congress earlier this week, and he was repeatedly lectured by Republicans to avoid the “optics” problem of cutting interest rates just before the 2024 presidential election. Powell sidestepped that question.

I still think a September rate cut of of 25 basis points is possibility. From today’s Wall Street Journal report:

After the release of the report, investors dialed up bets that the Fed would cut rates twice this year, and the odds of a third cut climbed, implying the central bank could lower rates at its last three meetings of the year, in September, November, and December.

And here is commentary from inflation analyst Michael Ashton:

Overall, there’s no doubting that this number is soothing for the Fed. It’s soothing for me too. Inflation is decelerating, and as I said last month I think the Fed will almost certainly deliver a token ease in the next couple of months. …

The potential issue is that inflation isn’t slowing for the reason the Fed thinks it is. The economy is slowing, and unemployment is rising. … An ease will follow shortly. Whether that is followed by further eases remains to be seen, but…for now…the trends are favorable for the central bank.

And now, I am going to restart my vacation.

* * *

Follow Tipswatch on X (Twitter) for updates on daily Treasury auctions and real yield trends (when I am not traveling).

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Pingback: Projection: Social Security COLA for 2025 should be around 2.7% | Treasury Inflation-Protected Securities

Gasoline prices have been going up the last few weeks, and service inflation is still hot, so we will have to wait for a few more readings before inflation appears to be no longer a problem. I recall a number of inflation head-fakes in the past. Powell is appropriately cautious. Unfortunately for him, any cuts in the Fed funds rate before November will look like he is being influenced by the upcoming election. Looking long term, if Trump is elected and he follows through on significant tariffs, prices will go up. Personally, I like a 5% Fed funds rate caused by inflation, because my expenditures are relatively low, so aside from food, inflation does not bother me much.

Also, as I mentioned earlier, 5% is very close to the average Fed funds rate of 4.86% over the last fifty years (1971-2022). Despite Wall Street cry-babies, most of us, somehow, have survived and many have prospered with the average Fed funds rate at 4.86%.

Hard for Wall Street to complain when markets keep hitting all-time highs.

Wall Street seems to complain about everything that does not increase the price of stocks. Speaking of inflated prices, housing prices and most stock indices are in crazy land. Crashes are spectacular when they happen. But of course nobody knows when. We only know that they will happen.

Seems like a good time to pull the ripcord on my IBonds and swing to Treasuries. My guess is they will keep massaging the numbers as much as they can for Biden. Prices of goods and services are still way higher than they were 2-3 years ago. That inflation of prices is still baked in.

And the inflation of the 1970s and 80s is still baked in as well.

To get rid of inflation, you have depression. I don’t think anyone wants a repeat of 1929.