By David Enna, Tipswatch.com

Welcome to the most important (and most delayed) inflation report of the year: For September, seasonally adjusted U.S. inflation increased 0.3% and the annual rate ticked up from 2.9% to 3.0%, the beleaguered Bureau of Labor Statistics reported today.

While 3.0% is a too-high rate of inflation, this report will be seen as relatively benign because it came in lower than expectations. Core inflation increased 0.2% for the month and held steady at 3.0%. All the numbers were lower than expected.

This is a very important report because it sets in stone the new variable rate for U.S. Series I Savings Bonds and also sets the Social Security cost-of-living adjustment for payments in 2026. So let’s dive in.

I Bond variable rate

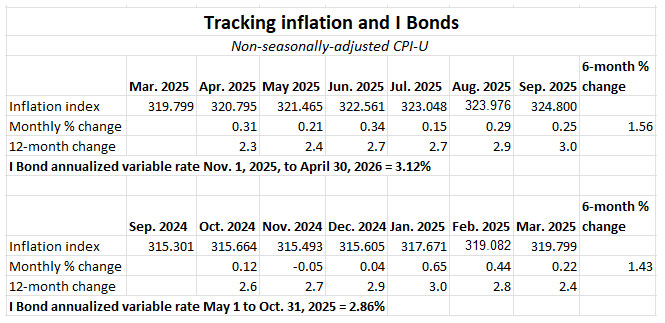

I Bond investors are interested in non-seasonally adjusted inflation, which is used to set future interest rates for I Bonds and also inflation accruals for Treasury Inflation-Protected Securities. The BLS set the September inflation index at 324.800, an increase of 0.25% over the August number.

That was the final piece needed to set the I Bond’s new variable rate, which will eventually roll into effect for all I Bonds, no matter when they were issued.

The new six-month, annualized variable rate will be 3.12%, up from the current 2.86%. Here are the data:

The I Bond’s permanent fixed rate will also update November 1, but we can’t say for certain what that rate will be. My projection, based on the 0.65 ratio formula that has worked for a decade, is that the fixed rate will fall to 0.90% from the current 1.10%.

If the fixed rate does drop to 0.9%, the new composite rate for purchases from November 2025 to April 2026 will be 4.03%, higher than the current 3.98%

What does this mean for investors? Although the variable rate will rise for November purchases, it is a better move to make investments in October (no later than Oct. 28) to lock in the fixed rate of 1.10%, which is permanent. You’d get 3.98% for six months and then 4.23% for the next six months.

For TIPS. The September inflation report means that principal balances for all TIPS will increase 0.25% in November, after rising 0.29% in October. Here are the new November Inflation Indexes for all TIPS.

Social Security COLA

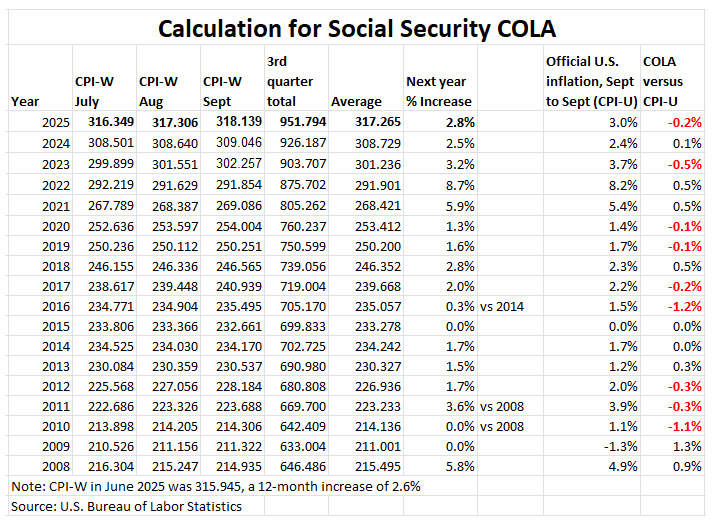

The September inflation report was the third of three — for July to September — that determine the Social Security Administration’s cost-of-living adjustment for payments in 2026. The SSA uses a three-month average of a different index, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), to set its COLA.

For September, the BLS set CPI-W at 318.139, which produced a three-month average of 317.265, an increase of 2.8% over the same average for 2024. That means the Social Security COLA will be 2.8% for payments beginning in January. The numbers:

Note that the COLA increase of 2.8% lags the official annual rate of inflation at 3.0%. That’s disappointing, but it is not uncommon.

The COLA increase will boost the average Social Security payment by about $56 to an average monthly benefit of $2,071, starting in January. However, we are likely to see larger increases in Medicare costs, to be announced in November.

And, yes, I will pat myself on the back for this July 18 post: Forecast: Social Security COLA for 2026 should be around 2.8%

The inflation report

And now, much-delayed news from the BLS, which because of the shutdown assembled a skeleton staff to create this September inflation report. It reassured us with this: “Note that September CPI data collection was completed before the lapse in appropriations.” But that won’t be true for the October report.

No price data have been collected this month. The White House today announced that the October inflation report is not likely to be released because of the lack of data.

For September, the BLS noted that a 4.1% increase in gasoline prices was the largest factor in monthly inflation. But gasoline prices remain down 0.5% year over year. More from the report:

- Food at home costs increased 0.3% for the month and are up 2.7% year over year.

- The meats, poultry, fish, and eggs index rose 0.3% in September and 5.2% over the last 12 months.

- Shelter costs were up a relatively mild 0.2% after rising 0.4% in August. The annual increase was 3.6%.

- Costs of new vehicles rose 0.2% for the month and just 0.8% for the year.

- Costs of used cars and trucks fell 0.4% for the month but are up 5.1% for the year.

- Airline fares rose a sharp 2.7% for the month and are up 3.2% for the year.

- Motor vehicle insurance costs fell 0.4% for the month (finally!) but remain up 3.1% for the year.

It’s hard to quickly spot price increases related to tariffs, but apparel costs rose 0.7% in September. Meat costs were up 1.3% for the month and 8.5% for the year. Fresh vegetable costs rose 2.6% for the month.

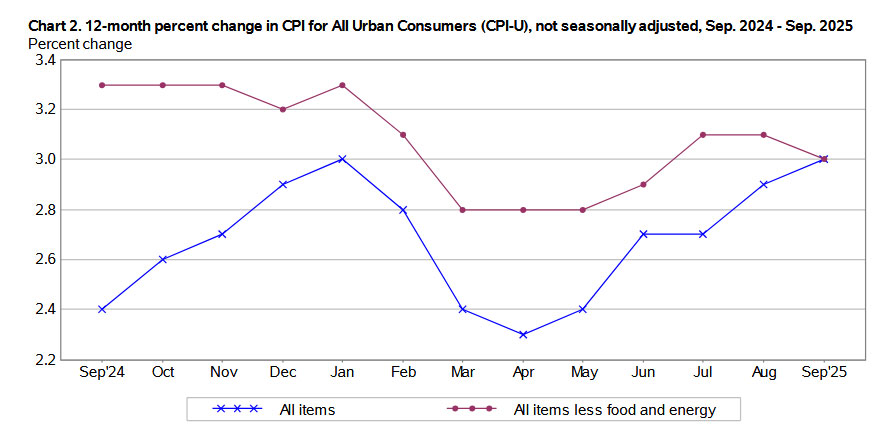

Here is the annual trend for all-items and core inflation, showing the “not beautiful” alignment at 3.0%:

What this means for interest rates

So we got a “plus” that inflation was a bit lower than expected, along with a “minus” that 3.0% annual inflation is too high to sustain. (And it will probably go higher in coming months.)

The Federal Reserve at this point seems focused on a weakening U.S. labor market, so today’s relatively OK inflation report should allow it to continue its rate-cutting cycle. We can assume a 25-basis-point rate cut is coming next week, but without October inflation data the Fed will be flying blind into its December meeting.

From today’s Bloomberg report:

The lower-than-expected reading is a welcome surprise, especially for several Fed officials who are leery of cutting rates further. While the central bank was already widely expected to lower borrowing costs at its meeting next week, the report may help convince policymakers that they can do so again in December — especially in the absence of other official reports should the shutdown continue.

For the good of the nation, let’s hope this government shutdown ends soon and we can again see normal data flow. This is extremely important for creating trust in the stock and bond markets.

—————————

Donate? This site is free and I plan to keep it that way. Some readers have suggested having a way to contribute. I would welcome donations. Any amount, or skip it, your choice. This is completely optional.

—————————

Follow Tipswatch on X for updates on daily Treasury auctions and real yield trends (when I am not traveling).

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear. Please stay on topic and avoid political tirades. NOTE: Comment threads can only be three responses deep. If you see that you cannot respond, create a new comment and reference the topic.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Pingback: Inflation Upside: I Bond Rates Are Back Above 4% – MillionaireFinder.com

Pingback: Inflation Upside: I Bond Rates Are Back Above 4% - News Online Business

Pingback: I Bond Charges Are Again Above 4%, Due to Inflation - Webbizmarket.com

Pingback: Series I Bonds Rate May 2025: 3.98%

Hi David,

I found this simple calculator on line:

https://treasuryviewer.com/calculator.html

Simple to use.

Rob

Isolation of the USA’s participation in global trade could result in inflation for sure for many necessities.

Hi David

The Economist for October 18-24 has a very interesting special report on “The Coming Debt Emergency.” They discuss the various options available to policy makers to address this, and conclude there is a large chance they will choose to print money to suppress interest rates and thereby cause higher than normal inflation. Makes TIPS and I Bonds look great.

Except, there is Buttonwood opinion column on page 70 cautioning that in a high inflation scenario, governments may be tempted to default on TIPS-like bonds. Yikes!

Thoughts?

I read The Economist report as well. Their leader piece caught my attention last week:

The rich world faces a painful bout of inflation: Governments are living far beyond their means. Sadly, inflation is the most likely escape.

For those with a subscription, here is the link to full special report and the Buttonwood column about how inflation-indexed bonds (‘linkers’) might fare under an inflationary spiral:

Investors in TIPS and I Bonds should hope the second scenario plays out.

No one should hang their hat on any particular economic forecast, but the Economist is one I pay attention to. Back in April 2020, the magazine accurately predicted that the covid pandemic would cause inflation to return. An inflationary resurgence in the next 10-15 years seems like a good bet.

I’ve often wondered – how could the government minimize the damage under a default scenario? It seems like savings bonds (I and EE) would be the first to be wiped out, since they are held by Mom and Pop type investors. In other words – that particular selective default would be the lowest systemic risk. But – compared to the general debt holdings of the government – savings bonds are a tiny share. So it would be pretty ineffective.

But I agree, there really is only one tool to address the debt and that is a hyper increase in the money supply.

The backlash to defaulting on savings bonds would be devastating. I don’t think that will happen.

The impact of class action should also be a consideration

Get in and lock in while you can. Take full advantage of the gift box loophole while it exists.

Whether fiscally responsible or not, fed interest rates are headed lower. A lot lower.

You’re not going to see a fixed iBond rate anywhere near this in the future.

An interesting discussion related to today’s release regardless of which side of the government reliability spectrum you reside:

https://wolfstreet.com/2025/10/24/massive-outlier-in-owners-equivalent-of-rent-pushed-down-cpi-core-cpi-core-services-cpi-something-went-awry-at-the-bls/

Hi David, thanks for the reporting as always. I’ve relied on your posts for information and guidance for years now and have always appreciated your direct, no-frills approach.

Have you seen the e-mail from TreasuryDirect regarding C of I balances, and if so, do you have any thoughts? If you’ve not seen it (I think it was only sent to people who had a nonzero balance in C of I; I had some left over in interest from a T Bill), here’s the body of the email I received:

On the heels of the deprecation of purchasing paper I bonds using tax refunds and the earlier emails regarding gift box purchases, it seems as though the Treasury is gearing up for some kind of major redesign of the securities purchase/redemption/transfer system, or at least that’s my take, but was curious if you agreed or had another viewpoint.

Readers have alerted me to this and I have an article ready to post on Sunday morning. There was too much news at the end of the week to post it earlier.

Pingback: New I-Bonds Rate Projection: 4.02% APY (Variable 3.12% + Fixed .9%) - Doctor Of Credit

“No price data have been collected this month. The White House today announced that the October inflation report is not likely to be released because of the lack of data.” Then how will the inflation component of TIPS be calculated for October?

Please correct me if I am wrong but it seems to me the lack of an October report should have no direct impact on most existing TIPS. The November report, which hopefully will be released, would have updated numbers that span the gap. That report would form the basis for the TIPS index ratios in January, including January 15 when the next coupons are due on existing 10-year TIPS. Where I do see a possible issue is in the December reopening auction for the 5-year TIPS that was just auctioned: 91282CPH8.

…although my response does not take into account the impact on the secondary market. That didn’t occur to me until right after I hit the button to Reply.

I agree there would be no long-term effect for TIPS (or I Bonds). The Treasury will issue a “calculated” October inflation index based on inflation in the previous 12 months, so some inflation accruals will be applied in December for TIPS. When we eventually get an accurate number the accruals will automatically adjust in the January accruals.

The September inflation report was crucial because it set the Social Security COLA, which had to be announced by November 1, plus set the six-month variable rate for the I Bond.

It’s unfortunate that 3% inflation is seen as acceptable.

Is 3% becoming the new 2% level and fully acceptable?

If so, that’s a 50% debasement each 24 years.

The Fed rate cuts say more about their concern about their employment mandate than it does their inflation mandate.

David – Great report and thank you for giving us a way to tip you.

Great summary! For I Bond investors, you could see this coming. The key sentence is this one:

“You’d get 3.98% for six months and then 4.23% for the next six months.”

That’s already a good deal on its own. But when you factor in Fed interest rate cuts almost guaranteed next week and further rate cuts possible in the coming months, the delta between I bonds and nominals looks increasing even more positive as time goes on.

Buy now!

I should add that this is a very unique time — to have the Fed lower interest rates in a time of gradually rising inflation which has gone from 2.4% to 2.5% to 2.7% to 2.9% to 3.0% since tariff policy was implemented in April. If that seems counter-intuitive, it is. It’s a reflection of a slowing economy and a decreasing employment rate, a lot of which traces back to the tariffs.

The GDPNow model of the Atlanta Fed forecasts a 3.9% annual GDP growth for Q3, and in Q2 GDP growth was 3.8%, which followed a contraction of -0.6% in Q1 2025. How can we describe increased growth as a “slowing economy”?

P.S. — the growth rates in 2024 for Q2 and Q3 were 3.0% and 3.1%, respectively, so even on a year-over-year basis growth is stronger (pending the actual numbers for Q3 2025).

I was referring to annual GDP by full calendar year, not quarterly.

Real GDP growth in 2023 and 2024 was reported by the Buteau of Economic Analysis (BEA) at 2.9% and 2.8%, respectively.

The BEA forecast for real GDP growth in calendar year 2025 is 1.7%.

The headline (trailing 12 month) inflation was 2.3% in April, is now 3% and if we have the same rate of inflation as this month for each of the next three months, the headline rate will be 3.7%.

It is a unique time. Higher interest rates did not choke off the economy; lower rates, in my opinion, won’t be stimulative.

Thanks for the typo correction. April CPI was indeed 2.3%, not 2.4%. I tend to agree that another 25 basis point rate cut by the Fed will not be materially stimulative, unless it trickles down to lower mortgage rates. That could help the housing market but is usually a lagging impact. But lowering rates in a period of rising inflation will not reverse rising inflation. Tariff impacts are not over. The Fed was adamant in its goal of getting inflation down to its 2% target. It looks like they’ve given up for now.

I did not mean it as a correction! And I agree that tariff impacts are not over, no matter what the upcoming SCOTUS decision will be.

I do not think even materially lower interest rates will be stimulative. Certainly we had very low interest rates post the global financial crisis, and inflation that was lower than present, but growth was generally considered subpar. I may be just extrapolating the past, though.

Housing is a difficult market to analyze for many reasons. I would be surprised if lower rates stimulated the housing market enough to have a big impact on the economy, though any improvement in affordability would be welcome. Unfortunately, affordability is more than just interest rates – incomes, insurance, repairs, property taxes, etc.

As you said, it’s a unique time.

Even though you didn’t intend it to be a correction, I’m glad you pointed out the 2.3% April CPI. I missed that typo, and accuracy is important especially where numbers are concerned.

I’m curious if there have been other periods of rising inflation in the modern era where the Fed was simultaneously lowering rates. And if so, what the impact was on inflation.