By David Enna, Tipswatch.com

These are dire times for investors looking for both safety and a return that can surpass or at least approach U.S. inflation. If you are retired, it’s a double whammy: You want to set aside cash for future needs, but you will earn only pennies on many thousands of dollars.

The Federal Reserve in March dropped its key short-term interest rate, the Federal Funds Rate, to a range of 0.0% to 0.25%, which translates to an effective rate of about 0.05% to 0.09%. And it is actively purchasing Treasurys — and even corporate bonds — to suppress longer-term interest rates. Most importantly, the Fed is signaling that these ultra-low rates will continue at least through 2021, and probably much longer, even if inflation perks up above 2%.

Here’s the outlook from a Barron’s report this week:

“We’re going to be in a zero-rate policy interest-rate environment for three-to-five years, so investors’ need of yield, which has been very strong, is only going to go up,” says Ashok Bhatia, deputy chief investment officer for fixed income at Neuberger Berman in New York.

“in an environment where 5-year government bonds yield 0.25% and 10-years are at 0.67%, from an income standpoint or preservation of capital standpoint, it’s hard to make an argument that government bonds serve much of a role for investors right now.”

Obviously, some investors are going to give up “safety” to pursue yield. The other alternative is to try to live with below-inflation returns on cash and near-cash investments. But there is an alternative.

What is safe?

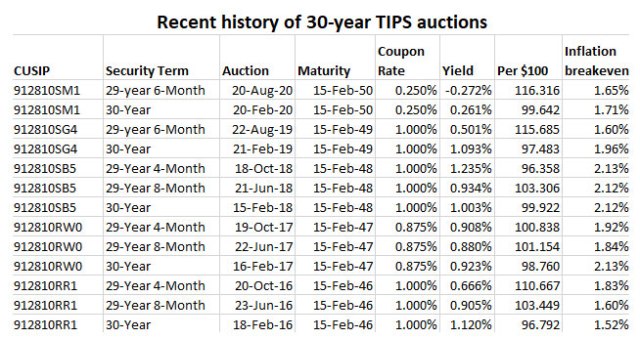

I’ve been writing about U.S. Series I Savings Bonds and Treasury Inflation-Protected Securities for nearly 10 years, with the idea that these investments can be purchased and — in the case of TIPS — be held to maturity with total safety and total expectation of a return of principal. Both investments are backed by the full faith and credit of the U.S. government.

As part of the bigger financial picture, I have recommended setting aside a portion (maybe up to 10%) of a portfolio to total safety, in investments that are backed by the U.S. government or insured by the Federal Deposit Insurance Corporation. The rest of the portfolio would then be invested in traditional stock and bond allocations, preferably in low-cost and tax efficient index funds.

So, for the purposes of this article, I am going to define “safety” as investments that are backed or insured by the U.S. government, with zero intention to trade for capital gains. And I am going to ask the question: Is there a way — in September 2020 — to combine reasonable yield with total safety?

The answer is, yes, there is: With U.S. Savings Bonds.

Let’s look at how the two Savings Bonds: Series EE and Series I, compare with similar, but much more widely followed, safe investments.

Nominal superstar: EE Bond

I call Series EE Savings Bonds “lowly,” because they are often ridiculed and ignored — and most importantly, misunderstood — in the financial press. The basic terms for EE Bonds have remained unchanged since November 2015, so they are a financial relic. But just as a reminder, in November 2015, a 20-year Treasury was yielding 2.6%. Today, it is yielding about 1.3%, a drop of 130 basis points.

You might have read that an EE Bond pays a fixed rate of 0.1%, and that looks awful. But it is also misleading. In essence, an EE Bond is a 20-year investment, and it must be held for 20 years to reach its superstar status. Here are the Treasury’s terms, which have been in effect since June 2003:

Treasury guarantees that for an electronic EE Bond with a June 2003 or later issue date, after 20 years, the redemption (cash-in) value will be at least twice the purchase price of the bond. If the redemption (cash-in) value is not at least twice the purchase price of the electronic bond as a result of applying the fixed rate of interest for those 20 years, Treasury will make a one-time adjustment at the 20 year anniversary of the bond’s issue date to make up the difference.

Because of this guarantee of doubling in value, an EE Bond yields a remarkable 3.5% compounded and tax-deferred, if held for 20 years. There is no comparable safe investment, anywhere.

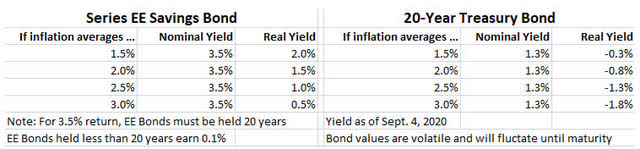

In fact, an EE Bond is likely to have a real return (meaning above inflation) that also surpasses the returns of I Bonds or TIPS. Here’s a comparison of the nominal and potential real returns of an EE Bond versus its most comparable investment, a 20-year Treasury bond:

Let’s put it this way: An EE Bond will double in value in 20 years. It would take about 55 years for a 20-year Treasury yielding 1.3% to double in value. An EE Bond is likely to outperform inflation. The return of a 20-year Treasury is likely to fall well below inflation.

But as a reminder, there is only one way to invest in an EE Bond: Buy it today. Hold it 20 years. Double your money. Immediately redeem it. That 20-year holding term isn’t going to work for some investors. But for those who can swing it, the EE Bond is the best safe nominal investment around right now.

Another consideration is that the Treasury limits purchases of both EE Bonds and I Bonds to $10,000 per person per year. One strategy for EE Bonds — let’s say for an investor about 40 years old — would be to buy to the cap every year, and begin receiving $20,000 a year at age 60.

Inflation-adjusted superstar: I Bond

A U.S. Series I Savings Bond is an investment that offers a composite interest rate that combines two elements: 1) an inflation-adjusted variable rate that is reset in May and November based on official U.S. inflation, and 2) a fixed rate that stays with the I Bond until maturity. The fixed rate for I Bonds purchased today is 0.0%, and that means I Bonds in effect have a real, after-inflation return of 0.0%.

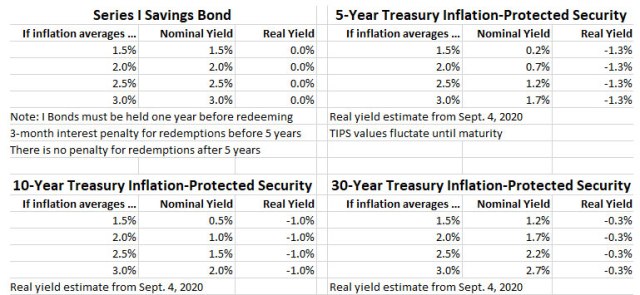

OK, a real return of 0.0% sounds awful, but it is actually excellent in today’s environment of negative real yields, across all maturities of U.S. Treasurys and insured bank accounts.

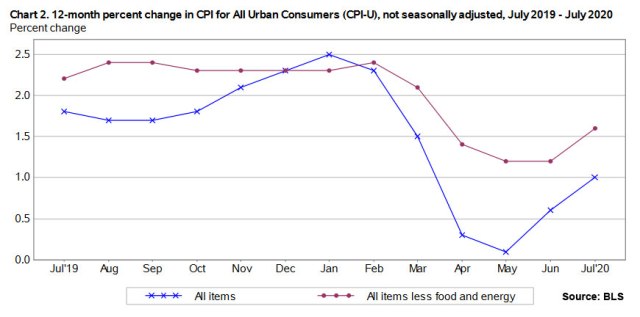

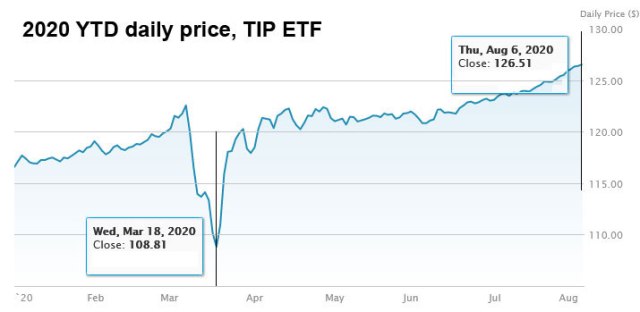

An I Bond with a fixed rate of 0.0% will accurately match U.S. inflation until it is redeemed, earning interest that is tax-deferred and offering excellent protection against deflation. In times of deflation, an I Bond never loses any value. This is not true for TIPS, which see principal balances fall after deflationary months. For these reasons, the fixed rate on I Bonds generally runs lower than the real yield of 5- and 10-year TIPS. But today, the reverse is true. An I Bond has a real yield about 130 basis points higher than a 5-year TIPS, and 100 basis points higher than a 10-year TIPS.

I Bonds are clearly the superior inflation-protected investment in September 2020. Here’s a comparison of real and potential nominal returns for I Bonds and TIPS under varying inflation scenarios:

I Bonds have a flexible maturity. They can be sold after 1 year with a three-month interest penalty, after five years with no penalty, or held for 30 years before redemption. These terms make them comparable with any maturity of TIPS, and I Bonds will out-perform TIPS across the entire maturity spectrum.

The Treasury limits I Bond purchases to $10,000 per person per calendar year. Those are electronic purchases at Treasury Direct. An investor can also receive up to $5,000 in paper I Bonds in lieu of a federal tax refund.

I Bonds cannot be purchased in a retirement account.

I Bonds as a 5-year investment

I Bonds can also be compared with a 5-year bank CD, since I Bonds can be redeemed after 5 years with no interest penalty. Because best-in-nation 5-year bank CDs are currently paying about 1.0%, inflation has to only average 1.0% a year over the next five years for the I Bond to outperform.

Here are how the inflation scenarios would transition to real and nominal returns:

In this case, the I Bond is the clear winner, outperforming the bank CD in any scenario where inflation averages higher than 1.0% in the next five years. The case is even worse for a 5-year Treasury note, with a nominal yield of only 0.30%.

I Bonds as a short-term investment

I generally advise buying and holding I Bonds until you need the cash for other purposes. That is the only way to build a sizable amount of inflation-protected cash, because of the $10,000 a year limit. But I Bonds can also work as a short-term investment in a pinch. You can’t sell an I Bond for the first 12 months, but after that, it can be redeemed with a three-month interest penalty.

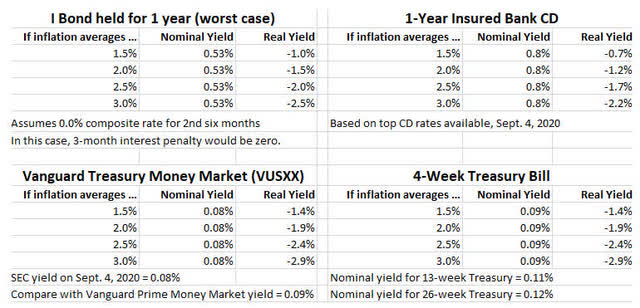

That makes a short-term I Bond directly comparable to a 1-year insured bank CD, currently yielding about 0.80% at best-in-nation outlets. It could also be used as a replacement for a Treasury money-market account or a strategy of rolling over 4-week Treasury bills. Here is how that math works out, using the worst-case scenario for I Bonds:

What is this “worst-case scenario”? It assumes that the March to September inflation rate will come in at 0.0% or lower, which would cause the I Bond’s inflation-adjusted variable rate to drop from the current 1.06% to 0.0% on November 1. If investors purchase an I Bond before November 1, they would get an annualized rate of 1.06% for six months, and then 0.0% for six months, adding up to an annual return of about 0.53%. There would be no three-month penalty, because interest in the last three months would be zero.

So, the worst an I Bond investor could do in one year is a return of 0.53%, which underperforms the 1-year bank CD (at 0.80%), but outperforms a Treasury money market fund or a strategy of rolling over 4-week Treasury bills.

This worst case scenario isn’t likely, however. At this point in the six-month rate-setting period, inflation has been running at 0.38%, creating a variable rate of 0.76%, and translating to a 1-year return of about 0.72% after the interest penalty, still slightly lower than 1-year bank CD.

Conclusion

Most investment advisers aren’t going to tell you about U.S. Savings Bonds because 1) they seem boring and 2) there is no money in suggesting them. They can be purchased without sales commissions or carrying costs at Treasury Direct.

EE Bonds deserve strong consideration for any investor seeking safety, plus top-notch yields combined with a 20-year time frame. No other safe investment comes close to a 3.5% yield, tax-deferred and free of state income taxes. EE Bonds are also likely to outperform TIPS and I Bonds, unless inflation soars above 3.5% in coming years.

I Bonds offer a real return that will match official U.S. inflation while never losing a dollar of value during deflationary periods. Earnings are also tax deferred and free of state income taxes. Because TIPS yields are negative to inflation across the entire maturity spectrum, I Bonds are the best inflation-protected investment, and over the longer term should create nominal returns that beat other safe investments like U.S. Treasurys and bank CDs.

* * *

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

I was happy to get the nearly 2% above inflation on this issue. I'm also still nibbling at long-term bonds…