Summary

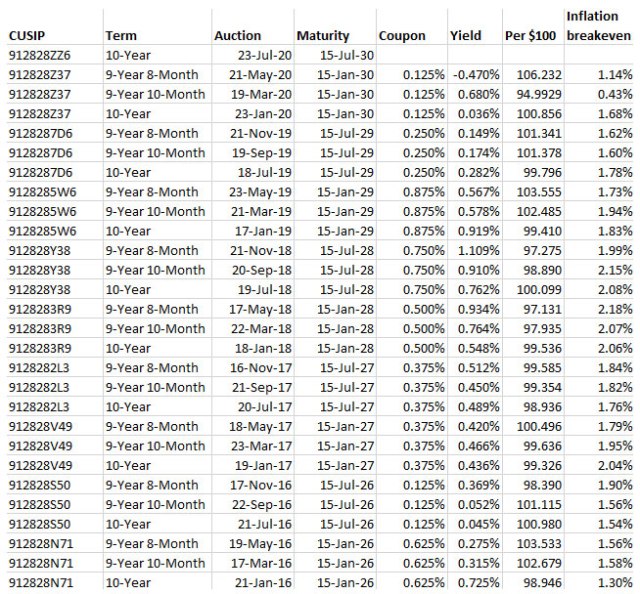

- The Treasury will reopen CUSIP 912810SM1 in a Thursday auction, creating a 29-year, 6-month TIPS.

- The real yield looks likely to be around -0.26%, making this the first TIPS of this term to get a negative real yield.

- Investors will probably pay a huge premium, about 16% above par value. This TIPS isn’t attractive for a buy-and-hold-to-maturity investor.

- But for a TIPS trader, it might have speculative appeal.

The U.S. Treasury will be offering $7 billion Thursday in a reopening auction of CUSIP 912810SM1, creating a 29-year, 6-month Treasury Inflation Protected Security. Do I think you should invest in this TIPS? No. But let’s look at it anyway.

I had already planned on doing what the editor said about selling my I-bonds with 0 or .4% fixed rates…