By David Enna, Tipswatch.com

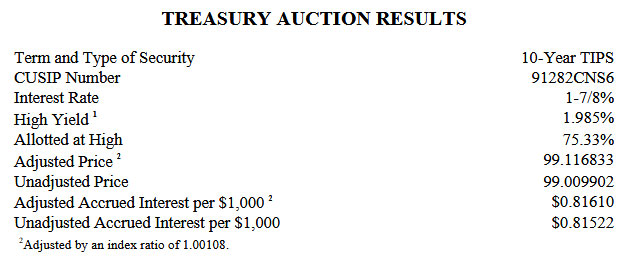

The Treasury’s largest 10-year TIPS auction in history got a warm welcome from investors, generating a real yield to maturity of 1.985% — a bit below expectations, an indication of solid demand.

The auction size was $21 billion, up from $20 billion at the most recent originating auction in January, and up from $19 billion last July. But investors were not daunted. The “when-issued” yield prediction for this auction was 1.99%, but the result came in slightly lower, a good indication of demand. The bid-to-cover ratio was 2.41, also showing decent demand.

This is CUSIP 91282CNS6, a new 10-year Treasury Inflation-Protected Security that will mature on July 15, 2035. Its coupon rate was set at 1.875%.

Definition: The “real yield to maturity” of a TIPS is its yield above official future U.S. inflation, over the term of the TIPS. So a real yield of 1.985% means an investment in this TIPS would provide a return that exceeds U.S. inflation by 1.985% for 10 years.

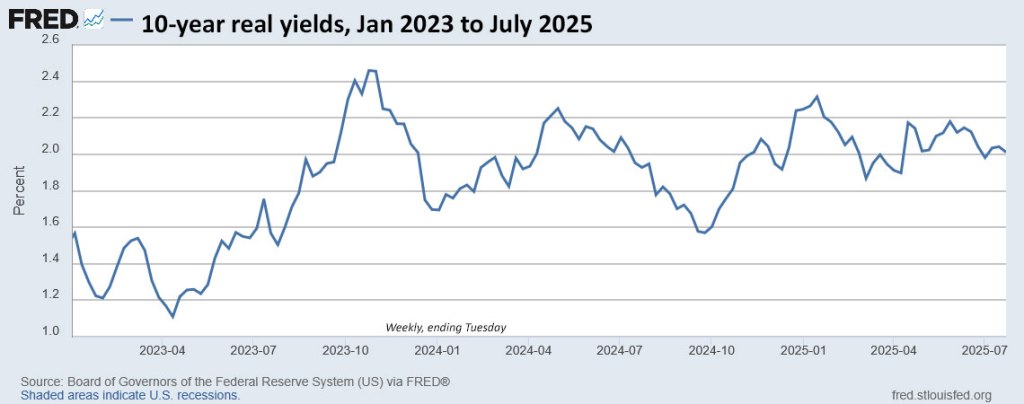

The auctioned yield was slightly below recent trading in the 10-year TIPS market, which has seen real yields hovering around 2.0%. Here is the trend in the 10-year real yield over the last 2 1/2 years:

Pricing

Because the real yield of 1.985% was above the coupon rate of 1.875% — which is always the case with a new TIPS — CUSIP 91282CNS6 auctioned at a discounted unadjusted price of 99.009902. In addition, this TIPS will carry an inflation index of 1.00108 on the settlement date of July 31. With that information, we can calculate the exact cost of a $10,000 par value investment at today’s auction:

- Par value: $10,000

- Actual principal purchased: $10,000 x 1.00108 = $10,010.80

- Cost of investment: $10,010.80 x 0.99009902 = $9.911.68

- + accrued interest of $8.16.

In summary, an investor purchasing $10,000 of this TIPS at today’s auction paid $9.911.68 for $10,010.80 of principal as of the July 31 settlement. From that point on, the investor will earn accruals matching U.S. inflation, plus an annual coupon rate of 1.875% applied to inflation-adjusted principal.

Inflation breakeven rate

With the nominal 10-year Treasury note trading with a yield of 4.40% at the auction’s close, this TIPS gets an inflation breakeven rate of 2.41%, a bit higher than recent results. This means the TIPS will outperform the nominal Treasury if inflation averages more than 2.41% over the next 10 years. (I’d rule this as a toss-up, but I’d prefer the TIPS for its built-in inflation protection.)

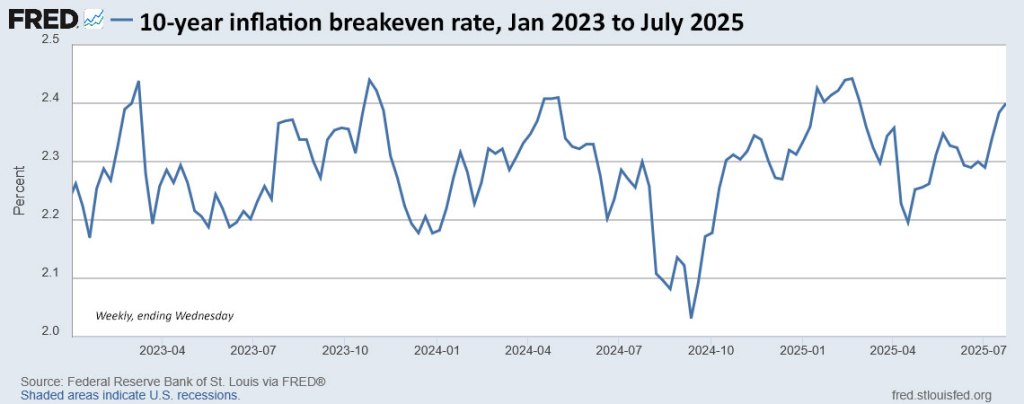

Here is the trend in the 10-year inflation breakeven rate over the last 2 1/2 years, showing the high volatility in inflation sentiment:

Auction thoughts

I wasn’t an investor (the 2035 rung is full on my TIPS ladder) but nevertheless I was holding out hope for the real yield to break higher than 2.0%, a nice milestone. It was close, but apparently solid demand kept a lid on the real yield.

No matter. The real yield of 1.985% is a solid result. No need for investor despair.

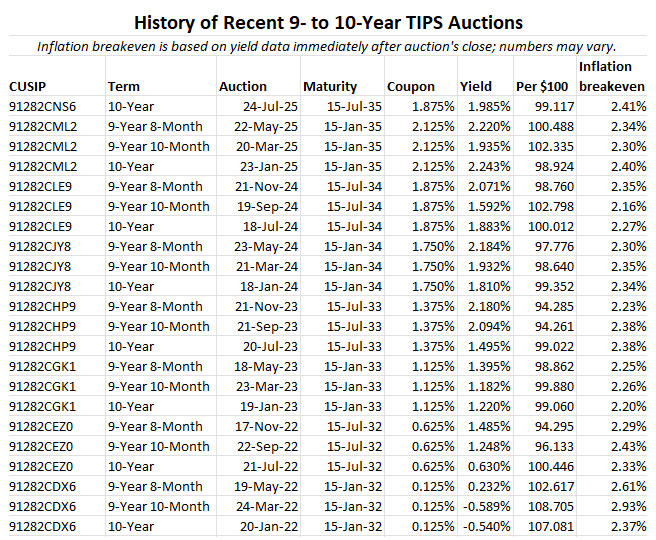

This TIPS will get reopening auctions in September and November and another new 10-year TIPS will be auctioned in January. It will be interesting to watch where the longer-term Treasury yields head in upcoming months. Here is a history of 9- to 10-year TIPS auctions over the last 3 1/2 years:

• Now is an ideal time to build a TIPS ladder

• Confused by TIPS? Read my Q&A on TIPS

• TIPS in depth: Understand the language

• TIPS on the secondary market: Things to consider

• TIPS investor: Don’t over-think the threat of deflation

• Upcoming schedule of TIPS auctions

—————————

Donate? This site is free and I plan to keep it that way. Some readers have suggested having a way to contribute. I would welcome donations. Any amount, or skip it, your choice. This is completely optional.

—————————

Follow Tipswatch on X for updates on daily Treasury auctions and real yield trends (when I am not traveling).

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear. Please stay on topic and avoid political tirades. NOTE: Comment threads can only be three responses deep. If you see that you cannot respond, create a new comment and reference the topic.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

I just sent a batch of paper I bonds out for electronic conversion. We’ll see how it goes.

I didn’t bite at this auction – but I’m looking with a keen eye towards August’s 30-year TIPS reopening. According to FRED, the real yield on the 30-year TIPS is 2.62% (as of 7/24.) I realize this can change quite a bit between now and the auction, but… 2.62% guaranteed real yield to maturity for a TIPS that will mature when I’m 82 really seems like an attractive proposition.

The 30-year auctions generally get the lowest readership of all my posts, probably because of the long term and high volatility. If you are 52, that puts you in the sweet spot for this investment, assuming you can hold to maturity. I have invested in a couple, years ago, in a taxable account at TreasuryDirect. One matures in Apr 2029 with a coupon rate of 3.875% and inflation index of 1.954. I made that investment in 1999 when I was 46 years old. Still holding it. (I’ll be posting an auction preview on Sunday, Aug. 17.)

I only worry that even a temporary spat of inflation from tariff impacts could reduce domestic spending and could lead to some kind of a decline in our consumer economy and cause some contraction (deflation) in the USA after a while.

My crystal ball is cloudier than ever on what we may be in store for in the next decade… a good Scout hopes for the best and plans for the worst is the way I was brought up… 2% rate above inflation could be really good or not on TIPS… who knows?

But, I read that on Friday the President said they are considering sending out more of some kind of citizen Fed rebate checks… confusing times we are living in.

ThomT, the idea of sending out a “tariff dividend” check to taxpayers is a horrible idea at a time of rising federal deficits. It would also likely cause a short-term surge in inflation, especially if it coincided with larger-than-normal tax refunds next year (due to provisions in the Big Beautiful Bill).

I agree.

I too made a sizeable purchase at the January auction, so didn’t participate. Do you have any hypothesis as to why the Treasury is increasing the size of TIPS auctions? I would think it would be more expensive for the Treasury to have to pay interest on accumulating inflation protected bills than otherwise, but perhaps they believe interest rates will come down and they won’t end up further in a hole. Any thoughts?

The Treasury said in February it is trying to better meet “the structural balance of supply and demand for TIPS … in order to maintain a stable share of TIPS as a percentage of total marketable debt outstanding.” Also, TIPS inflation accruals don’t have to paid out by the Treasury until maturity, so it does kick the can down the road.

Kicking the can down the road makes the most sense to me!