By David Enna, Tipswatch.com

The U.S. stock and bond markets were sent into turmoil Wednesday by confusing messaging from the Federal Reserve on future inflation and interest rates. As a result, the stock market plummeted and Treasury yields surged higher.

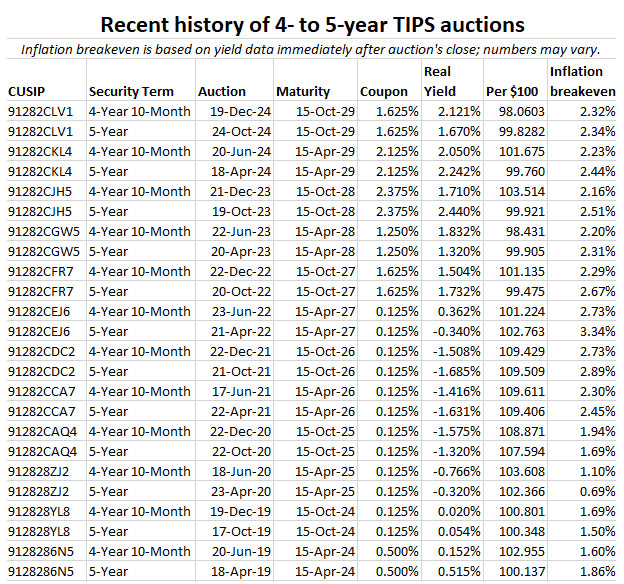

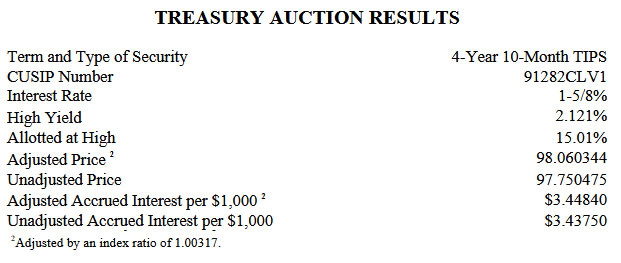

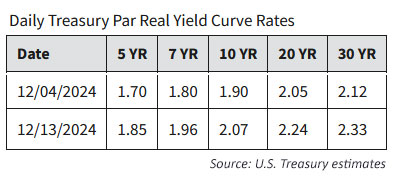

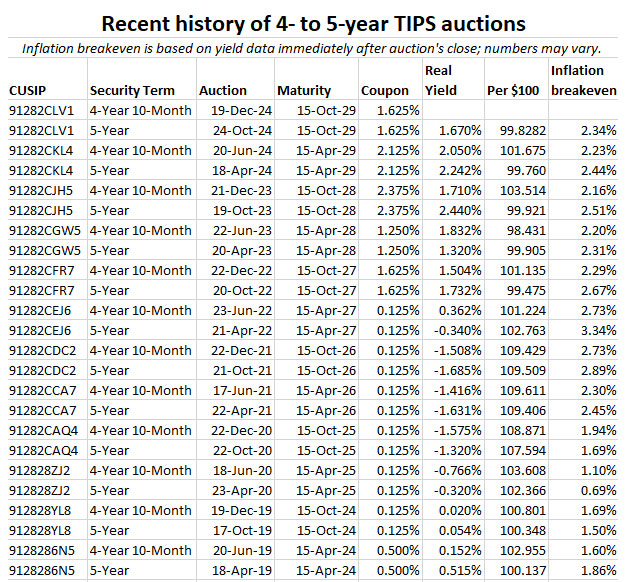

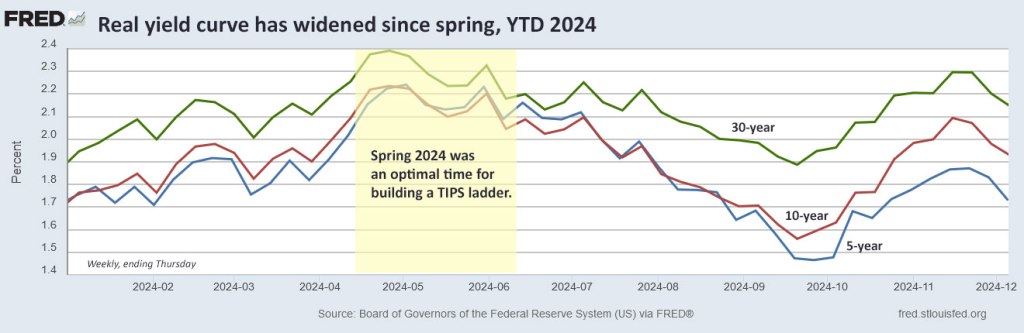

While that turmoil has lessened today, it had a strong effect on the Treasury’s auction of $22 billion in a reopened 5-year Treasury Inflation-Protected Security, CUSIP 91282CLV1. Before the Fed action on Thursday, this TIPS was trading on the secondary market with a real yield to maturity of about 1.85%. In the aftermath Wednesday afternoon, the yield surged to about 2.02%.

And then … today’s auction resulted in a real yield of 2.121%, about 7 basis points higher than the “when-issued” prediction of 2.05% set just before the auction’s close. The bid-to-cover ratio was 2.1, by far the lowest for any 4- or 5-year auction since I began tracking this number in 2019. (The lowest previously was 2.36 in October 2023.)

In other words, demand for this TIPS was extremely weak. But for investors, the result was excellent: a real yield to maturity of 2.121% and a price below par value.

Definition: The “real yield” of a TIPS is its yield above or below official future U.S. inflation, over the term of the TIPS. So a real yield of 2.121% means an investment in this TIPS would provide a return that exceeds U.S. inflation by 2.121% for 4 years, 10 months.

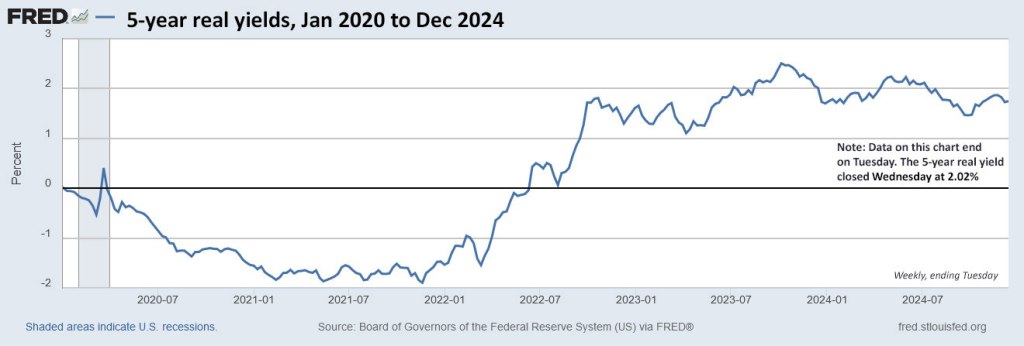

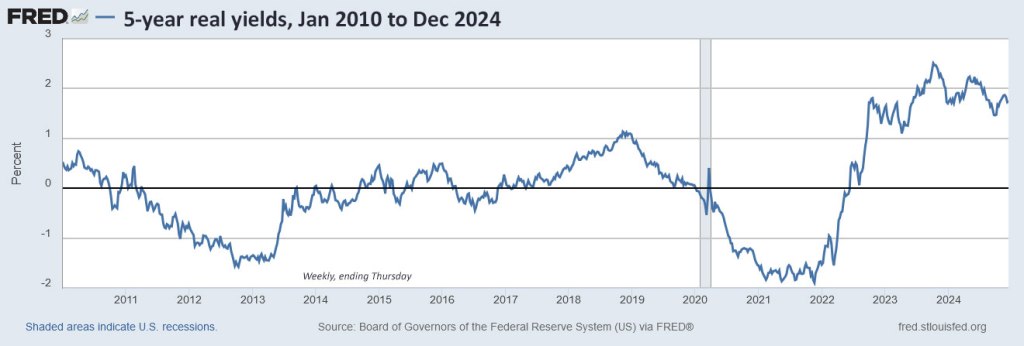

Here is the trend in the 5-year real yield over the last four years, ending on Tuesday, a day before the surge higher:

Pricing

CUSIP 91282CLV1’s coupon rate of 1.625% was set by the originating auction on Oct. 24, which resulted in a real yield of just 1.670%, a remarkable 45 basis points lower than today’s result. Today’s auction got an unadjusted price of 97.750475. It also will carry an inflation index of 1.00317 on the settlement date of Dec. 31. With that information, we can calculate the cost of $10,000 par value at this auction:

- Par value: $10,000.

- Actual principal purchased: $10,000 x 1.00317 = $10,031.70

- Cost of investment: $10,031.70 x 0.97750475 = $9,806.04

- + Accrued interest of $34.48.

In summary, at investment of $10,000 par at this auction cost $9,806.04 for $10,031.70 principal on the settlement date of Dec. 31. After that, the investor will receive inflation accruals plus an annual coupon rate of 1.625% until maturity.

Inflation breakeven rate

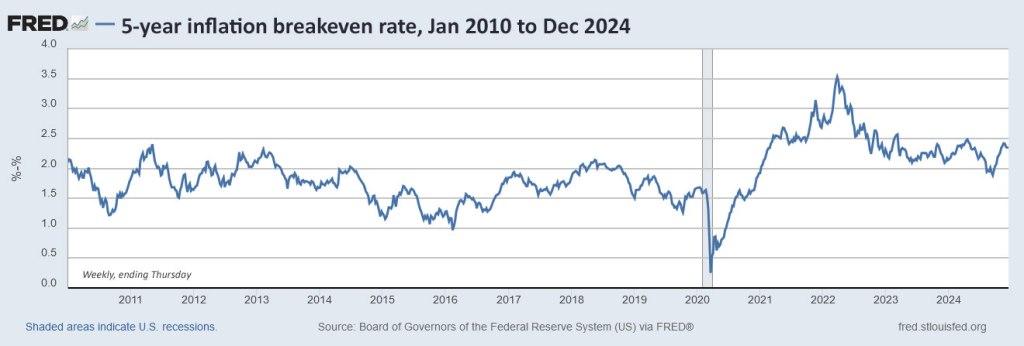

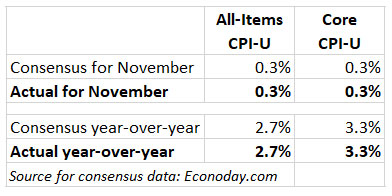

With a 5-year nominal Treasury note yielding 4.44% at the auction’s close, this TIPS gets an inflation breakeven rate of 2.32%, a bit lower than looked likely last week. This means it will outperform the 5-year T-note if inflation averages more than 2.32% over the next 4 years, 10 months.

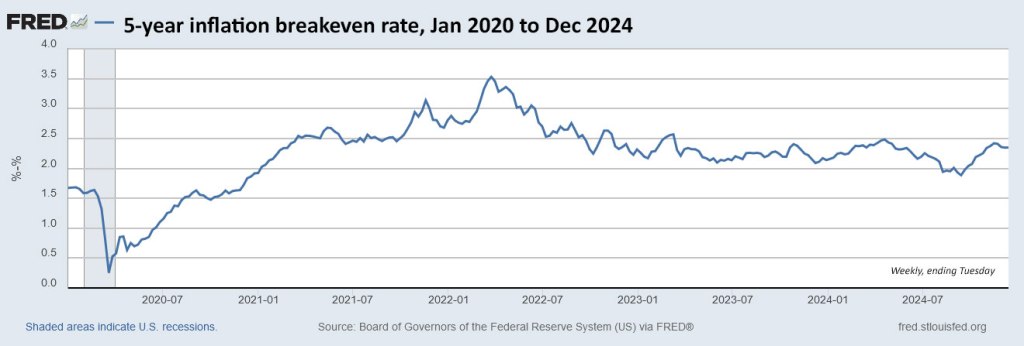

Here is the trend in the 5-year inflation breakeven rate over the last four years:

Reaction to the auction

The fact that demand was so weak is a stunner. It could be that investors were reacting to the Fed’s apparently renewed commitment to fighting inflation. The dip in the inflation breakeven rate backs that up. It could also be that nominal Treasurys are looking more attractive by comparison with yields in the 4.40% range.

This is from MarketWatch’s coverage posted after the auction close:

Thursday afternoon’s $22 billion sale of 5-year Treasury inflation-protected securities came in “very weak” with a tail of 6.7 basis points, according to BMO Capital Markets strategist Vail Hartman.

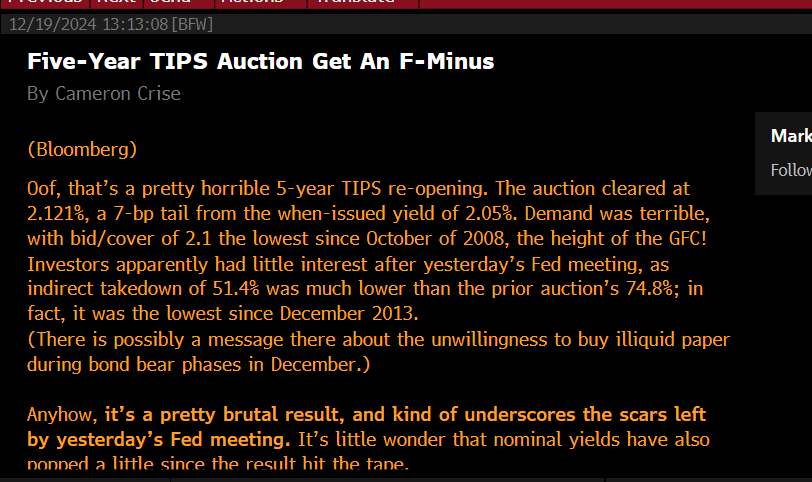

And here is a bit more blunt reaction from Bloomberg’s Cameron Crise, picked up from a tweet:

Buyers at this auction should be pleased. This is one where the auction ended up producing a better result than buying on the secondary market. The weak demand seems obviously related to uncertainty about future inflation and a potential hold in short-term interest rates.

And then, on top of all that, Congress is now struggling to avoid a government shutdown. Fun times, huh?

This was the last TIPS auction of 2024. The next auction will Jan. 23, 2025, with the unveiling of a new 10-year TIPS to mature in 2035. I plan to be a buyer of that one.

• Now is an ideal time to build a TIPS ladder

• Confused by TIPS? Read my Q&A on TIPS

• TIPS in depth: Understand the language

• TIPS on the secondary market: Things to consider

• TIPS investor: Don’t over-think the threat of deflation

• Upcoming schedule of TIPS auctions

* * *

Follow Tipswatch on X (Twitter) for updates on daily Treasury auctions and real yield trends (when I am not traveling).

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear. Please stay on topic and avoid political tirades. NOTE: Comment threads can only be three responses deep. If you see that you cannot respond, create a new comment and reference the topic.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

I did exactly the same as you and decided to dollar cost average as I was so unsure this time.…