May inflation set another 40-year high. Food, gas and shelter prices were key factors, but prices were up in every category.

By David Enna, Tipswatch.com

This is getting a bit dangerous, don’t you think?

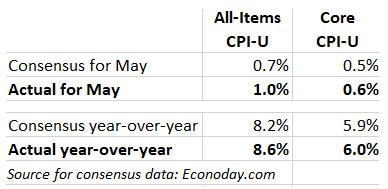

Seasonally adjusted U.S. inflation increased 1.0% in May, the U.S. Bureau of Labor Statistics reported today, much higher than the already-scary 0.7% predicted by economists. The year-over-year number rose to 8.6%, the largest 12-month increase since the period ending December 1981. Economists had been predicting the annual number would fall to 8.1%, down from April’s 8.3%.

Core inflation, which removes food and energy, also exceeded economist predictions, coming in at 0.6% for the month and 6.0% year-over-year.

The higher-inflation surprise wasn’t actually a surprise, since economists have been under-predicting U.S. inflation for more than a year. But this was a very big miss.

In its usual understated tone, the BLS said the May price increases were “broad-based.” (No kidding! There wasn’t a single major price category with declining prices.) The indexes for shelter, gasoline, and food were the largest contributors to the May all-items increase. Let’s take a look at some of the numbers:

- Gasoline prices were up 4.1% in May, after falling 6.1% in April. Gas prices are now 48.7% higher than a year ago. (And we can be sure these costs will soar again in June.)

- Food prices continued surging, with the food-at-home index rising 1.2% in the month and 10.1% over the last year, the highest annual increase since the period ending April 1979. The BLS noted that all six major grocery store food group indexes rose in May.

- The index for dairy prices rose 2.9%, its largest monthly increase since July 2007. The price of meats, poultry, fish and eggs was up a stunning 14.2% for the month.

- Shelter costs rose 0.6% in May and are up 5.5% for the year. This index seems likely to continue to rise as rent increases roll into the market.

- Airline fares were up 12.6% in May, after rising 18.6% in April.

- Apparel costs were up 0.5%, after falling 0.8% in April.

Here is the trend in year-over-year inflation over the last 12 months, showing how the all-items index continues soaring higher (thanks to gas and food prices), while core inflation has settled in around 6%, an intolerably high number:

What this means for TIPS and I Bonds

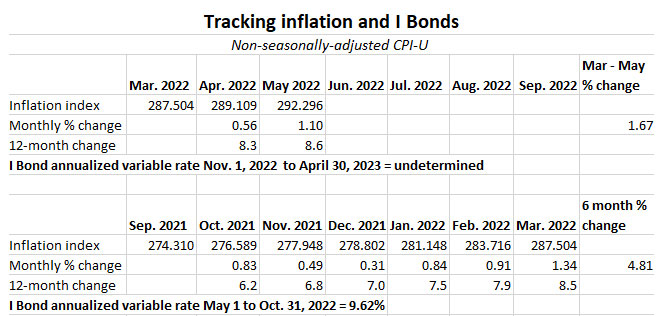

Investors in Treasury Inflation-Protected Securities and U.S. Series I Savings Bonds are also interested in non-seasonally adjusted inflation, which is used to adjust principal balances for TIPS and set future interest rates for I Bonds. For May, the BLS set the inflation index at 292.296, an increase of 1.1% over the April number.

For TIPS. The May numbers mean that principal balances for all TIPS will increase 1.1% in July, after increasing 0.56% in June. For the year ending in July, TIPS principal balances will have increased 8.6%. Here are the new July Inflation Indexes for all TIPS.

For I Bonds. The May number is the second in a six-month string that will determine the I Bond’s new variable rate, which will be reset on November 1 based on inflation from March to September. So far, just two months into this rate-setting period, the I Bond would get a variable rate of 3.34%. Since four months remain, a lot will change before the November reset.

Here are the data so far:

What this means for future interest rates

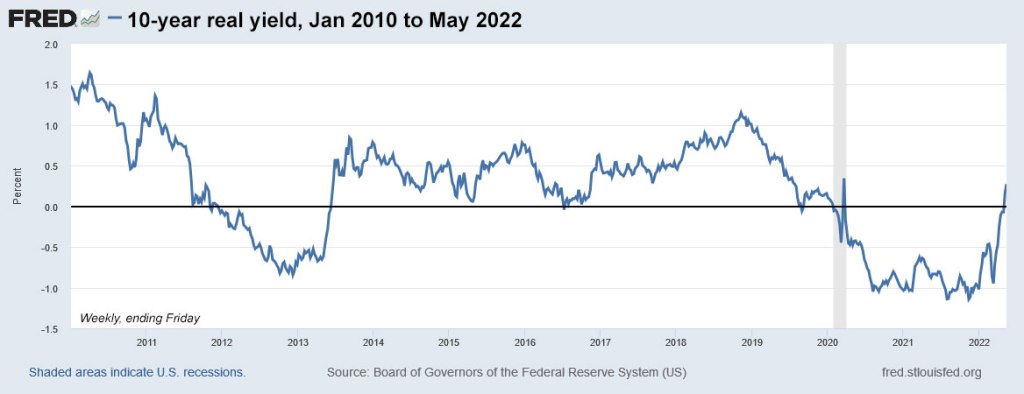

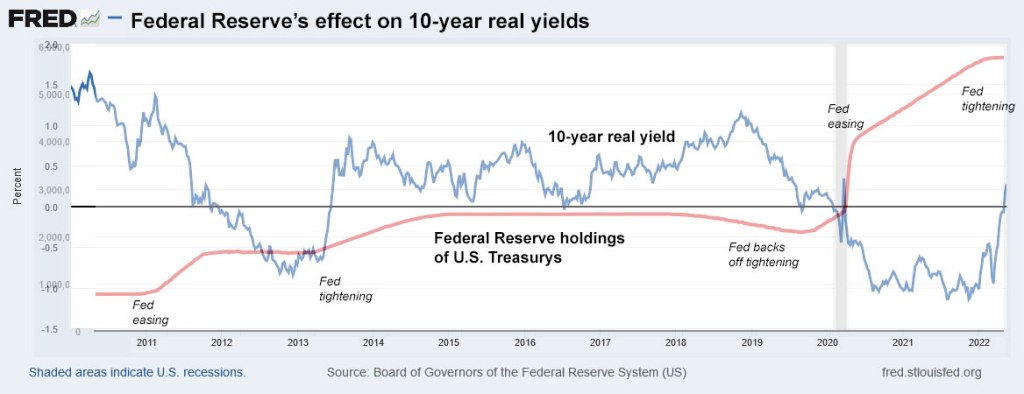

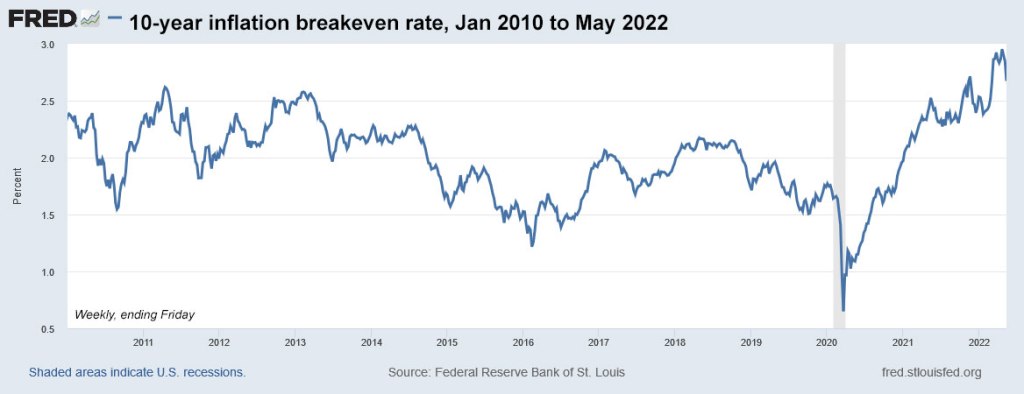

It’s clear that the Federal Reserve will have to continue its course of aggressive (some would say the course is actually moderately-aggressive) increases in short-term interest rates, while also slashing its huge balance sheet of U.S. Treasurys. A lot of this has been priced into the market already, but today’s inflation report clearly shows the Fed can’t veer off this course.

It’s likely that the yield curve will continuing flattening. A 5-year nominal Treasury is trading this morning with a yield of 3.13%, higher than the 10-year yield (3.06%) and equal to the current 30-year yield (also 3.13%). This is a strong signal that the financial markets fear a weakening U.S. economy, even as inflation continues at historically high levels.

From this morning’s Wall Street Journal report:

The continued rapid pace of price increases adds pressure on the Fed to raise rates aggressively to tame inflation. “The big picture is that inflation remains very stubborn and will continue to be very slow to recede,” said Sarah House, senior economist at Wells Fargo Securities. “With what we see in energy markets in the past few weeks, we are unlikely to have seen the peak in inflation this cycle yet.”

A key concern is this: Can the Fed continue to have the fortitude to fight inflation even if the U.S. economy begins slowing, the stock market declines and unemployment increases?

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

They did reply and quickly, the next day in fact. However no illumination on what the future holds: Hello Matthew,…