By David Enna, Tipswatch.com

The U.S. Treasury will offer $18 billion in a new five-year Treasury Inflation-Protected Security at auction on Thursday, April 22. This is CUSIP 91282CCA7, and its coupon rate and real yield to maturity will be set by the auction results.

I’ve been eyeing this offering for a few months, figuring it would be worth a look for investment. In a time of low yields, a 5-year TIPS becomes more appealing just because … the term is only five years, the lowest the Treasury offers for a TIPS.

But as Thursday’s auction approaches, this new TIPS isn’t looking appealing.

A TIPS is an investment that pays a coupon rate well below that of other Treasury investments of the same term. But with a TIPS, the principal balance adjusts each month (usually up, but sometimes down) to match the current U.S. inflation rate. So the “real yield to maturity” of a TIPS indicates how much an investor will earn above inflation.

Coupon rate. Although it will be set by the auction, this TIPS will get a coupon rate of 0.125%, the lowest the Treasury will go for any TIPS. That’s a 100% certainty.

Real yield to maturity. As of Friday’s market close, the Treasury was estimating the real yield to maturity of a 5-year TIPS at -1.73%, meaning an investor would be willing to receive a return that trails official U.S. inflation by 1.73% over the next five years. This would be the lowest real yield for any 4- to 5-year TIPS auction in history, surpassing the record -1.57% of the last auction of this term on Dec. 22, 2020.

Cost of the investment. Because the real yield looks likely to be about 186 basis points below the coupon rate, investors will have to pay a fairly lofty premium to receive the 0.125% coupon rate, plus future inflation adjustments. The adjusted cost should be somewhere around $109.30 for about $100.27 of value, after accrued inflation is added in. This TIPS will carry an inflation index of 1.00273 on the settlement date of April 30.

So in other words, investors are going to pay a premium of about 9% above par for this TIPS, and then will receive coupon interest of 0.125% plus accruals to principal matching inflation over 5 years.

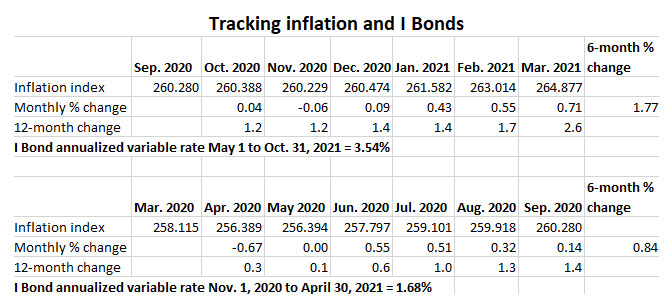

One positive factor in this equation is that the May inflation accrual will add 0.71% to the value of this TIPS, matching the rate of non-seasonally adjusted inflation in March 2021. Big-money investors know this, and it will be factored into Thursday’s auctioned price.

Here is the trend in the 5-year real yield over the last five years, showing the deep decline that began as the COVID-19 pandemic erupted in March 2020, forcing extraordinary measures by the Federal Reserve and Congress to stimulate the U.S. economy:

Negative real yields are not rare for TIPS, especially for the 5-year maturity. We’ve seen them often ever since the Federal Reserve began aggressive quantitative easing programs in 2011. But we’ve never seen a TIPS of any maturity auction with a real yield as low as -1.73%.

Remember that a negative real yield doesn’t necessarily mean that a TIPS won’t have a positive nominal yield or that it is a bad investment. The investment has to be viewed against the overall interest rate environment and current expectations for future inflation. So that brings us to …

5-year inflation breakeven rate

With a 5-year Treasury note currently trading with a nominal yield of 0.84%, this TIPS would get a 5-year inflation breakeven rate of 2.57% if the auction results in a real yield of -1.73%. That would not be a record high for a 5-year TIPS, but it is very high.

Essentially, this breakeven rate means that inflation will have to average higher than 2.57% over the next five years for this TIPS to out-perform a traditional, nominal Treasury. U.S. inflation is currently running at 2.6%, so that looks OK. But five-year inflation averages haven’t exceeded 2.5% for any period ending in April since 2004 to 2009, when inflation averaged 2.6%.

The inflation breakeven rate is determined by market sentiment, comparing a Treasury’s nominal yield to the real yield of a TIPS of the same term. This measurement has been notorious in recent years for overestimating inflation. Here is a look at the 5-year inflation breakeven rate going all the way back to 2003, showing that a rate above 2.5% is a rarity:

I’ve highlighted two very high rates of the past:

- On March 18, 2005, the 5-year inflation breakeven rate reached 2.92%. In the next five years, inflation averaged 2.4%. It overestimated inflation by 50 basis points a year.

- On July 3, 2008, the 5-year inflation breakeven rate was 2.72%. In the next five years, inflation averaged 1.2%. It overestimated inflation by 150 basis points a year.

A high inflation breakeven rate indicates that a TIPS is a pricey investment versus a nominal Treasury of the same term. I consider 2.57% high. TIPS at these levels are expensive.

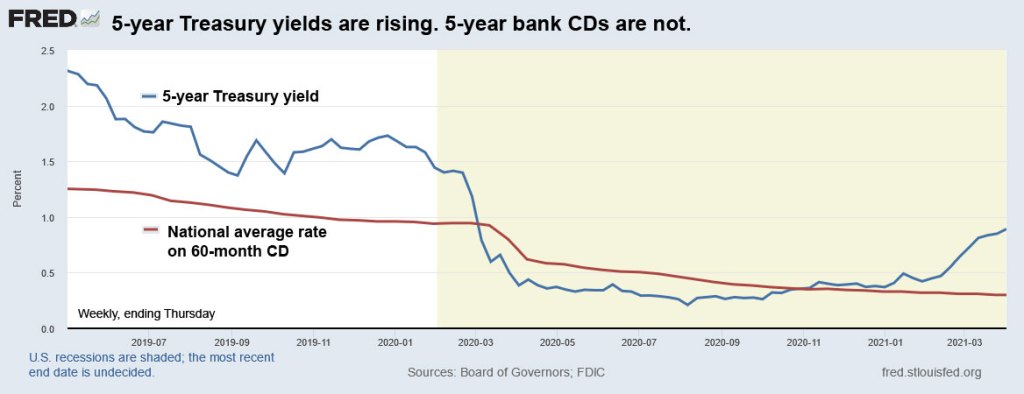

Here is a simple example of what this means: The 5-year Treasury note started 2021 with a nominal yield of 0.36% and now is yielding 0.84%, a gain of 48 basis points. A 5-year TIPS started the year with a real yield of -1.62% and now is yielding -1.73%, a decline of 11 basis points. The value equation has shifted toward nominal yields.

I’ve been tracking how TIPS have performed against nominal Treasurys over the last decade, and the results have been rather grim, as shown in this chart:

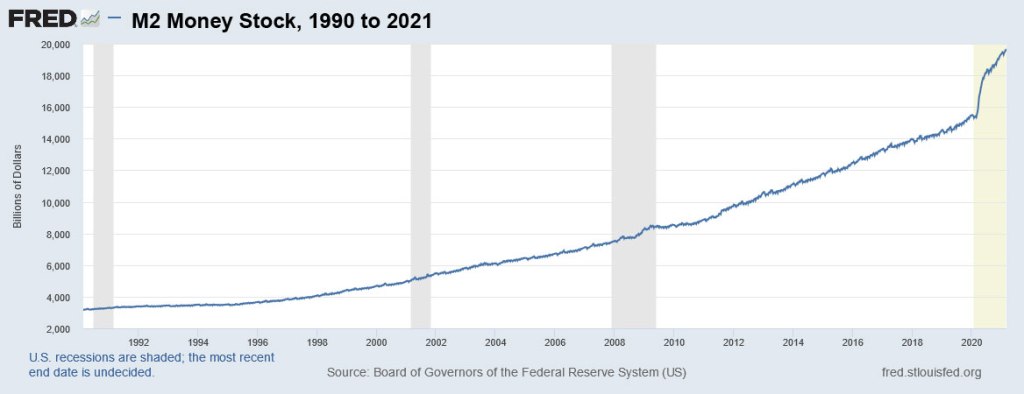

Of course, it’s possible we have entered a “new era,” with Federal Reserve and government stimulus pushing floods of easy money into the economy, spurring a new inflationary age. I do think that is possible. It’s definitely a reason to maintain a position in inflation-protected investments.

The math says: Invest in I Bonds

You can purchase a U.S. Series I Savings Bond today and get a fixed rate of 0.0%, which means its real yield is 0.0% and your investment will very closely match future U.S. inflation for as long as you hold the I Bond. That is a 173-basis-point advantage over a 5-year TIPS, and it means that an I Bond has a huge advantage as an investment, beyond the facts that it offers tax-deferred earnings, a flexible maturity and better deflation protection.

Yes, I Bonds have a purchase limit of $10,000 per person per calendar year. But the point is: Invest in I Bonds before you invest in TIPS in 2021. After you reach the cap, then consider a TIPS. And what about a 5-year Treasury or a 5-year bank CD? Here is how those investments compare, under varying inflation scenarios:

In every possible scenario where inflation averages higher than 1% a year, an I Bond will out-perform a 5-year TIPS, 5-year Treasury note or 5-year bank CD.

Also see: I Bond dilemma: Buy in April, buy in May, or wait until later?

For the TIPS, out-performance against the nominal Treasury and bank CD only begins once the U.S. inflation rate averages 2.57%.

Honestly, the 5-year nominal Treasury at 0.84% and 5-year bank CD at 0.80% appear to be ridiculously unappealing. In that light, the 5-year TIPS — with its insurance against unexpectedly high inflation — looks much more appealing.

So is a 5-year TIPS yielding -1.73% a horrible investment? No, it isn’t. But unless inflation surges in the next five years, it could provide nominal returns well under 1% a year. And while an investor is guaranteed to receive full par value at maturity, that 9% premium you’d pay on Thursday isn’t part of par value and isn’t guaranteed to be returned at maturity.

Auction facts

Thursday’s auction closes for non-competitive bids (meaning those through TreasuryDirect or your brokerage) a noon EDT, and will finalize at 1 p.m. I will be posting the results soon after the auction closes.

Despite my qualms about this issue, I’m expecting demand to be fairly high, given the recent trend driving real yields lower, indicating investor demand.

Here’s a history of recent 4- to 5-year TIPS auctions, showing the current record low yield of -1.575% at the last auction on Dec. 22, 2020.

* * *

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

I found another work around. I had saved a December 2024 inventory. Opened it and 'return to savings bond calculator'…