By David Enna, Tipswatch.com

Last week I was being interviewed by CNBC’s Kate Dore about I Bond investment strategies, and I found myself asking her a question: “Do you think the Federal Reserve has learned a lesson?”

In other words, after a decade of manipulating the U.S. Treasury market and money supply, has the Fed really learned its actions can have dire consequences? We got a 40-year-high surge in inflation. Is the Fed done with all that?

We can’t know, of course. I asked this question because I have been getting a lot of feedback from readers and seeing heated discussions on the Bogleheads forum about this issue: Should I dump I Bonds to buy T-bills? It is a reasonable question because I Bonds with a 0.0% fixed rate will soon be earning 2.96% for six months. Even for new I Bonds, the May-to-October composite rate will fall to about 4.27% at a time when 4-week T-bills are paying 5.49%.

T-bills are going to have a 100-basis-point advantage over new I Bonds, and that is hard to ignore. For example, here are two perfectly logical comments from readers:

When interest rates were still very low, there was a 7.12%, 9.62% and then a 6.48% APR staring you right in the face. You’d be ignorant to not pounce on it. Add on the compounding interest and the money being safe, and you’re all set. However, the tide has turned and now I-bonds are still “okay” at 5.27% and 4.27% APR (average of 4.77%), but I can get a 4-week bond for 5.33% APR with no penalty and my money is available within 4 weeks.

And this:

Hard pass. This only makes sense if (1) fixed rate doesn’t go higher and (2) very long term. My savings accounts pay 5%+ and easy to lock 1-2 year CDs at 5-6%. Combine the 3 month penalty plus subpar 4.27% for 6 months and this is a loser.

These readers are thinking logically, because they are committed to investing for the short term, and as I noted in my recent article on the I Bond buying equation, I Bonds are no longer the most attractive investment for the short term.

But for the long term?

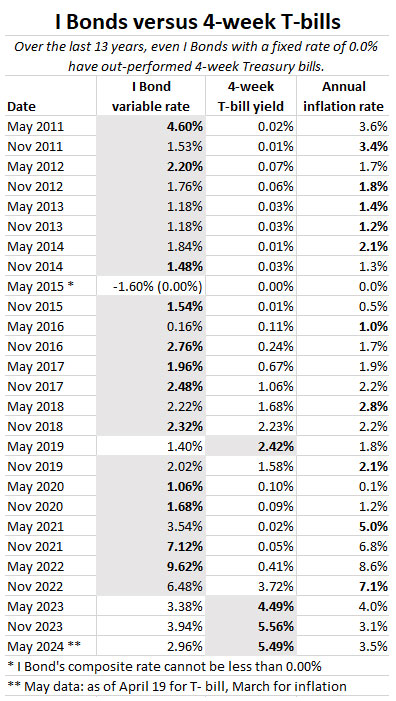

Over the last 13 years, even I Bonds with 0.0% fixed rates have greatly out-performed 4-week T-bills. Why? Because the Fed controls short-term interest rates, but has no actual direct control over U.S. inflation, which sets the I Bond’s variable rate. The results:

This gets back to my question: Has the Fed truly learned its lesson about manipulating the U.S. bond market? Will it now be unwilling to force nominal yields to close to zero and real yields below zero? I think it has, for the time being, and we won’t see ultra-low interest rates in the near future.

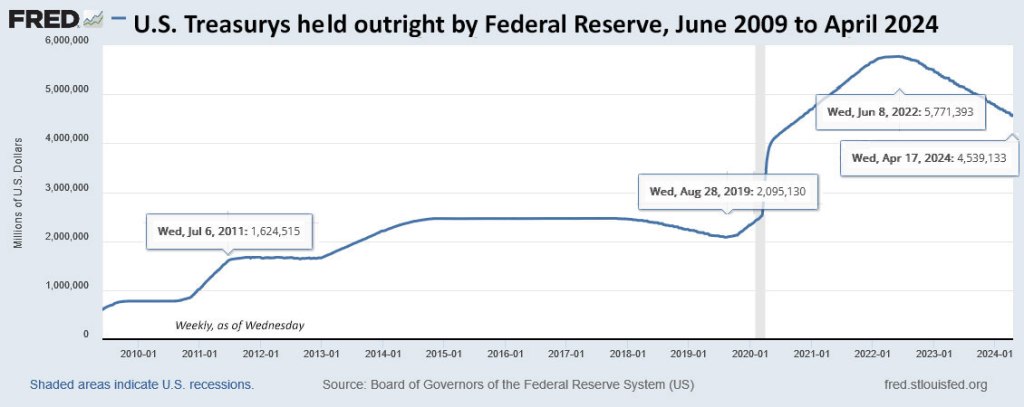

But what happens if the economy begins spiraling downward, or the banking system faces another crisis? Can the Fed resist the temptation to send interest rates tumbling and begin another phase of quantitative easing? Take a look at the Federal Reserve’s balance sheet of U.S. Treasurys since 2009:

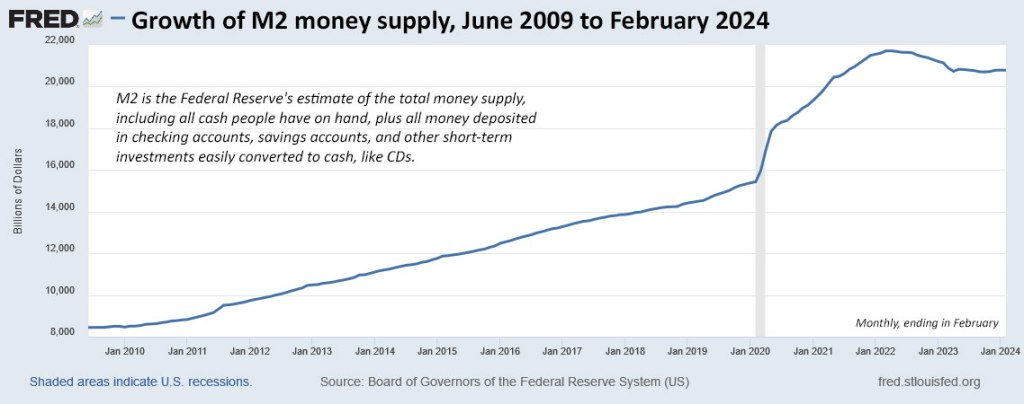

From August 2019 to June 2022, the Federal Reserve’s balance sheet of Treasury holdings increased 175%. And this was the effect on the U.S. money supply, combined with very generous direct payments to U.S. taxpayers during the Covid crisis:

And finally, the effect of the Fed’s actions on U.S. inflation over the same period:

These charts are relevant because the Federal Reserve is now considering paring back quantitative tightening, meaning it will slow down reduction of its balance sheet, even though it remains double the size of the 2020 level. This is from a recent Reuters report:

The Fed is currently allowing up to $60 billion per month in Treasury bonds and up to $35 billion per month in mortgage bonds to mature and not be replaced as part of a process called quantitative tightening, or QT.

“Participants generally favored reducing the monthly pace of runoff by roughly half from the recent overall pace,” the minutes said.

Most Americans will have no idea of this change, which eventually should help bring longer-term interest rates a bit lower. And in due course, the Fed will begin gradually lowering short-term interest rates, which will get noticed. The process should be slow and careful, as long as the U.S. economy remains healthy.

For the near-term, T-bills are going to offer better yields than I Bonds. Short-term investors should favor T-bills if their investing horizon is 2 years or less.

Some readers have suggested: “Well, if the T-bill yield falls I will just jump back into I Bonds.” The problem, though, is the $10,000 per person limit on purchases. It takes a long time to build a sizable holding in I Bonds, unless you use complicated strategies like tax-refund paper I Bonds and purchases through gift-box, trusts, or business-owner strategies.

And to be clear, I love T-bills and have been using staggered rollovers of 13- and 26-week T-bills as an emergency cash holding for nearly two years.

But for the longer-term, I Bond still make sense. They protect against unexpected future inflation and unexpected future Federal Reserve manipulation. If we see ultra-low interest rates again, even 0.0% fixed-rate I Bonds are going to offer a return matching inflation and well above T-bills. Today, I Bonds are selling with a permanent fixed rate of 1.3%, the highest in more than 16 years.

Another viewpoint …

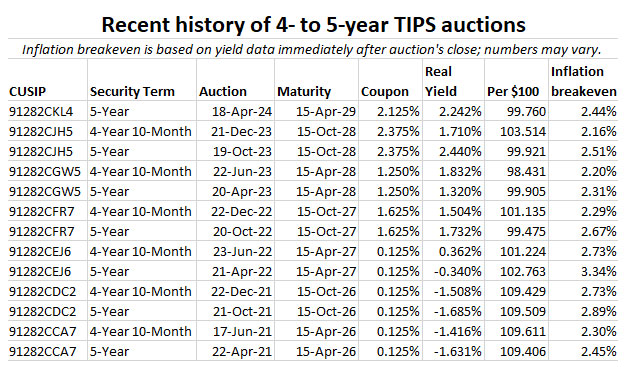

Here is a new video from Jim of the “I Was Retired” YouTube channel, addressing 5-year potential investments in Treasury notes, TIPS and/or I Bonds. The video is well organized and an accurate look at the three investments. (Another thing I really appreciate is that Jim has his liquor cabinet directly behind his filming stage. Yes, and I totally understand!):

• I Bond dilemma: Buy in April, in May, or not at all?

• Confused by I Bonds? Read my Q&A on I Bonds

• Let’s ‘try’ to clarify how an I Bond’s interest is calculated

• Inflation and I Bonds: Track the variable rate changes

• I Bonds: Here’s a simple way to track current value

• I Bond Manifesto: How this investment can work as an emergency fund

All Treasury issues are not taxed at the state or local level.